Whether you’re an employee or self-employed, you are required to contribute to the

Canada Pension Plan (CPP), but you may have noticed that the amount you’re required to contribute has been slowly climbing.

The reason for this is to support enhancements to the CPP program, which, once fully implemented, will increase the maximum CPP retirement pension by about 50 per cent. The first phase of enhancements started in 2019, and phase two begins in 2024, meaning CPP contributions will continue to escalate over the next couple of years.

The

Canada Revenue Agency this week released a helpful backgrounder that details the changes to the CPP system so far, as well as the major enhancements coming in 2024 and 2025. To help prepare you for what’s in store, let’s look at the changes already made and the ones to come.

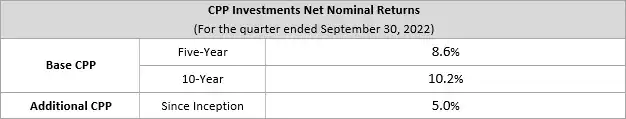

Let’s start with the basics. The CPP is a mandatory contributory pension plan, which covers nearly all Canadian workers, other than those in Quebec, who are covered by the Quebec Pension Plan (QPP). The CPP provides basic income replacement for its contributors and their families when the contributor retires, dies or becomes disabled. The CPP is financed by contributions from employees, employers and self-employed individuals, and the funds are professionally managed by the CPP Investment Board. As of Dec. 31, 2022, the CPP fund had a balance of $536 billion.

Since 2019, the CPP contribution rate has gradually increased every year, to 5.95 per cent in 2023 from 4.95 per cent in 2018 (before the enhancement), for a total increase of one per cent for both employees and employers. If you’re self-employed, you pay both the employee and employer portions, for a 2023 contribution rate of 11.9 per cent.

For 2023, Canadians over age 18 who make more than $3,500 annually contribute 5.95 per cent of their employment income (above this base amount) to the CPP, up to the

year’s maximum pensionable earnings (YMPE), which is $66,600 for this year. This YMPE is referred to as the “first earnings ceiling” in light of the upcoming enhancements. Given the YMPE of $66,600 and the basic exemption of $3,500, that means the maximum employee CPP contribution this year is $3,754 (or $7,509 if you’re self-employed).

If you earn less than the first earnings ceiling, there will be no further CPP rate increases for you. For higher income earners, however, a second CPP contribution rate and earnings ceiling will begin in January 2024, and will only affect workers whose income is above this “second earnings ceiling,” to be known as the year’s additional maximum pensionable earnings (YAMPE).

As of 2024, if you have earnings above the first earnings ceiling, you’ll contribute an additional four per cent (eight per cent if you’re self-employed) of your income between the first earnings ceiling up to the second earnings ceiling. This additional CPP contribution will be known as “second CPP contributions.”

The level of the second earnings ceiling will be based on the value of the first earnings ceiling. For 2024, the second earnings ceiling will be set at an amount that is seven per cent higher than the first earnings ceiling, and for 2025, the second earnings ceiling will be set at an amount that is 14 per cent higher than the first earnings ceiling.

To illustrate, assume Stephanie has an annual income of $100,000, which is higher than the second earnings ceiling each year. She will make base and first CPP contributions at a rate of 5.95 per cent and, beginning in 2024, second CPP contributions at a rate of four per cent on the difference between the annual YAMPE and the YMPE.

In 2023, Stephanie will make $3,754 of CPP contributions, being 5.95 per cent of the 2023 YMPE of $66,600, less the $3,500 base amount. For 2024, let’s assume the YMPE goes up to $67,700, which is the first earnings ceiling. The second earnings ceiling will be set seven per cent higher than the first at approximately $72,400. As a result, Stephanie in 2024 will contribute $3,820 of base and first-level CPP, and $188 of second-level CPP, for a total of $4,008.

In 2025, if we assume the YMPE increases again to, say, $69,700, Stephanie will contribute $3,939 on her income below the first earnings ceiling. The second earnings ceiling will be set 14 per cent higher than the first earnings ceiling, resulting in a YAMPE, or second earnings ceiling, of approximately $79,400. Stephanie will contribute second CPP contributions at a rate of four per cent on her income between the YMPE and the YAMPE, or $388. Thus, her total CPP in 2025 would be $4,327.

To help offset some of the contribution costs, employees can claim a 15-per-cent federal non-refundable credit on the base CPP contributions, which are calculated at a rate of 4.95 per cent, and a tax deduction for both first CPP contributions (one per cent), and the upcoming second CPP contributions.

Self-employed Canadians who contribute 9.9 per cent to CPP can claim a 15-per-cent non-refundable federal tax credit on 4.95 per cent of the base CPP contributions, and a tax deduction on the other 4.95 per cent. They can also claim a tax deduction on the enhanced portion of their contributions (two per cent in 2023).

It’s important to remember that not everyone will benefit fully from the CPP enhancements. How much your CPP benefits increase will depend on how much and for how long you contribute to the enhancements.