innsertnamehere

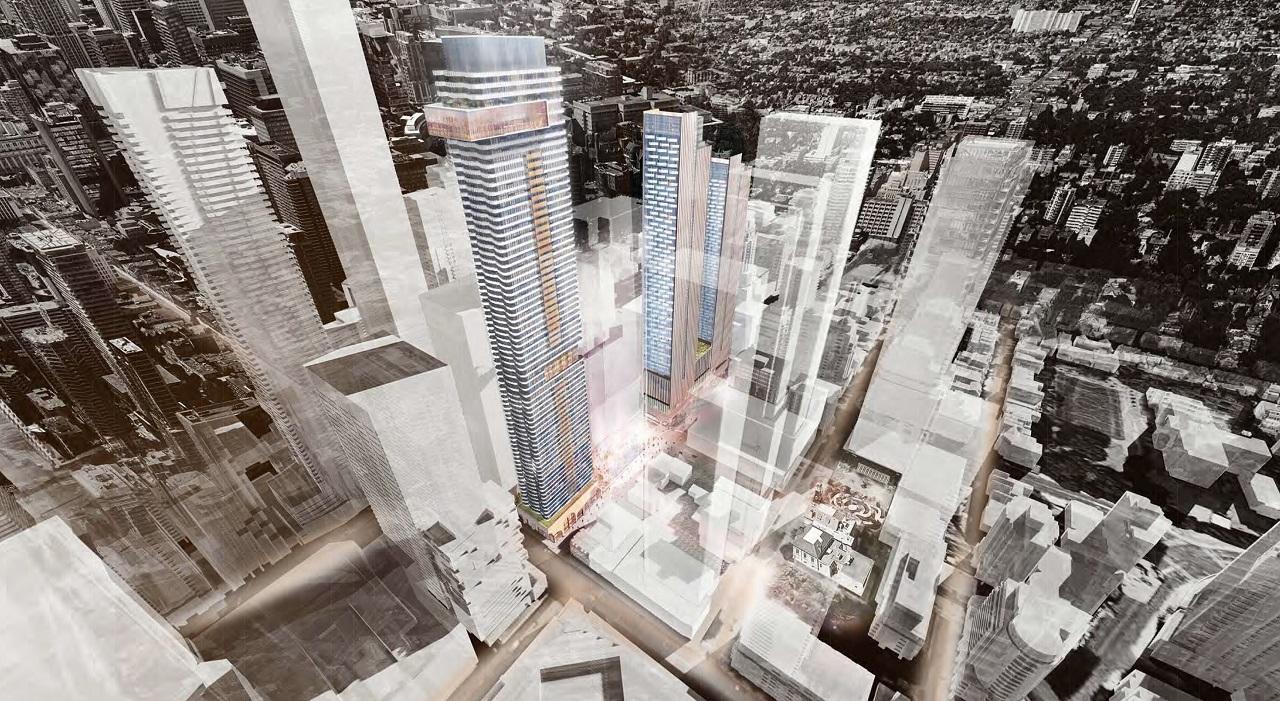

Superstar

why cut the height then and keep the floor count similar? Wouldn't it be better to keep the approved zoning envelope and increase GFA?At the end of the day, KingSett is vending this. So they'll try and pack as many floors in as possible and let the buyer figure out what they want to construct. It's more-appealing to the vendor to have the higher count as it makes the product more enticing, even if you know it's not feasible from a construction perspective (transfer slabs and other structure, M&E, etc. will eventually cut this down).

Also, Kingsett got its zoning here a while ago. Why process a site plan application if they are vending it, especially if they expect a buyer to modify the project significantly? Getting NOAC may make it more attractive but if they expect a buyer to make significant revisions, they are going to have to apply for a site plan amendment anyway..

Honestly I'd be more surprised if Kingsett builds this than vends it, but they are going much further with this site than they typically do before vending it, and are making odd decisions that seem to be focusing on getting this built as a rental development over maximizing value in preparation of vending it in my eyes..