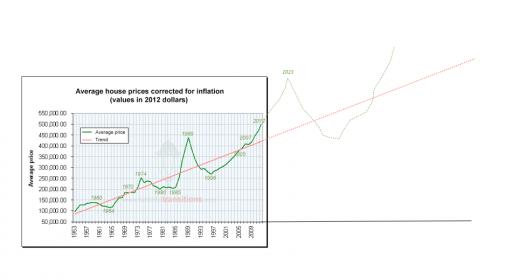

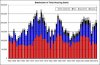

All of the bubbles examined in this paper share

a common form, as seen in Figure 14. Housing

prices start at a stable inflation-adjusted level

“A”. The housing bubble picks up steam, in

-

creasing inflation-adjusted prices to a new high

of “B”. From that point, the bubble bursts and

housing prices deflate to their new inflation-

adjusted level “C”.

In all of the bubbles examined in this paper,

the new average housing price after the bubble

burst (point C) is always higher than the initial

starting price at point A. As such, anyone who

held real estate through the entire cycle from A

through C will make money (in inflation-adjust

-

ed terms), despite a decline between the peak B

to the final price of C.

Often the process from A to C is quite lengthy,

requiring a decade or more.