They were told by BoC that rates would not move upwards until 2023. They also ignored inflation and called it transitory which they were wrong about. Should have kept their mouths shut and raised rates last year when inflation was on the path upwards.

They lowered rates to "save" the economy. Printed a bunch of money and told people to buy, buy, buy, now they're closing the barn door and we hear the "low rates weren't going to last forever". Of course they weren't, but BoC loses credibility here. Look completely clueless.

Hopefully these rate hikes will bring down all the increases in prices for goods and services but I highly doubt it. Let's see if food prices come down, Contractors and hadymen start slashing prices. Insurance comes down. Car prices will be slashed, etc. Can't wait

Only thing that will come down are home prices and I guess gas will eventually but rate hikes will have nothing to do with that.

,

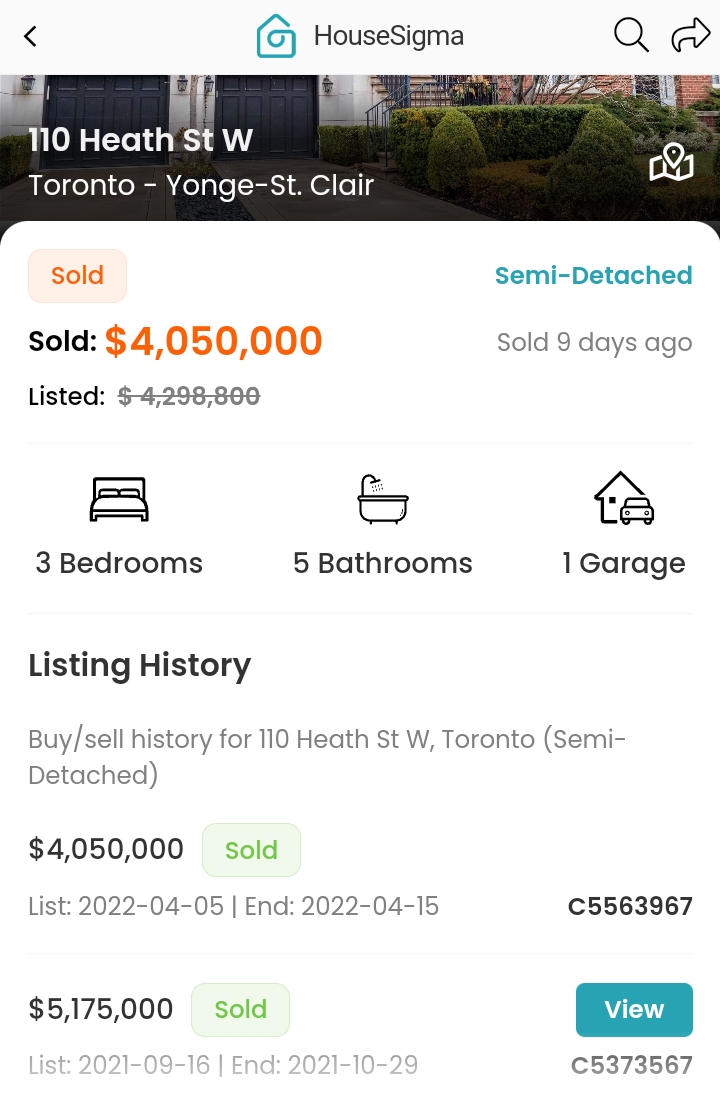

,  money laundry gone bad , bankruptcy or divorce ? , what's your guess

money laundry gone bad , bankruptcy or divorce ? , what's your guess