UrbanToronto has released the UrbanToronto Pro New Development Report showing statistics from October, 2022, which was a busy month in terms of news that affected the real estate industry, from the "More Homes Built Faster" Act, to the re-election of Mayor John Tory. These, however, came against the background of continuing increases in interest rates by the Bank of Canada, and increasing hesitancy in purchasing new, resale, or pre-construction homes across the city.

When it came to submitting applications for new developments to the City of Toronto, developers proposed a remarkably unremarkable mix of applications. Although the totals in terms of gross floor area and dwelling units proposed was on the lower end of the typical month, compared both to this year as well as last year's frenzy to build, the averages in terms of per-unit residential GFA, parking spaces per unit, and even retail space are much closer to normal levels. (The only remaining outlier is FSI, which is lower than normal due to the massive industrial project at 1845 Birchmount. Excluding that, then the proposed FSI for the month jumps to a respectable 3.7.)

On to the actual numbers:

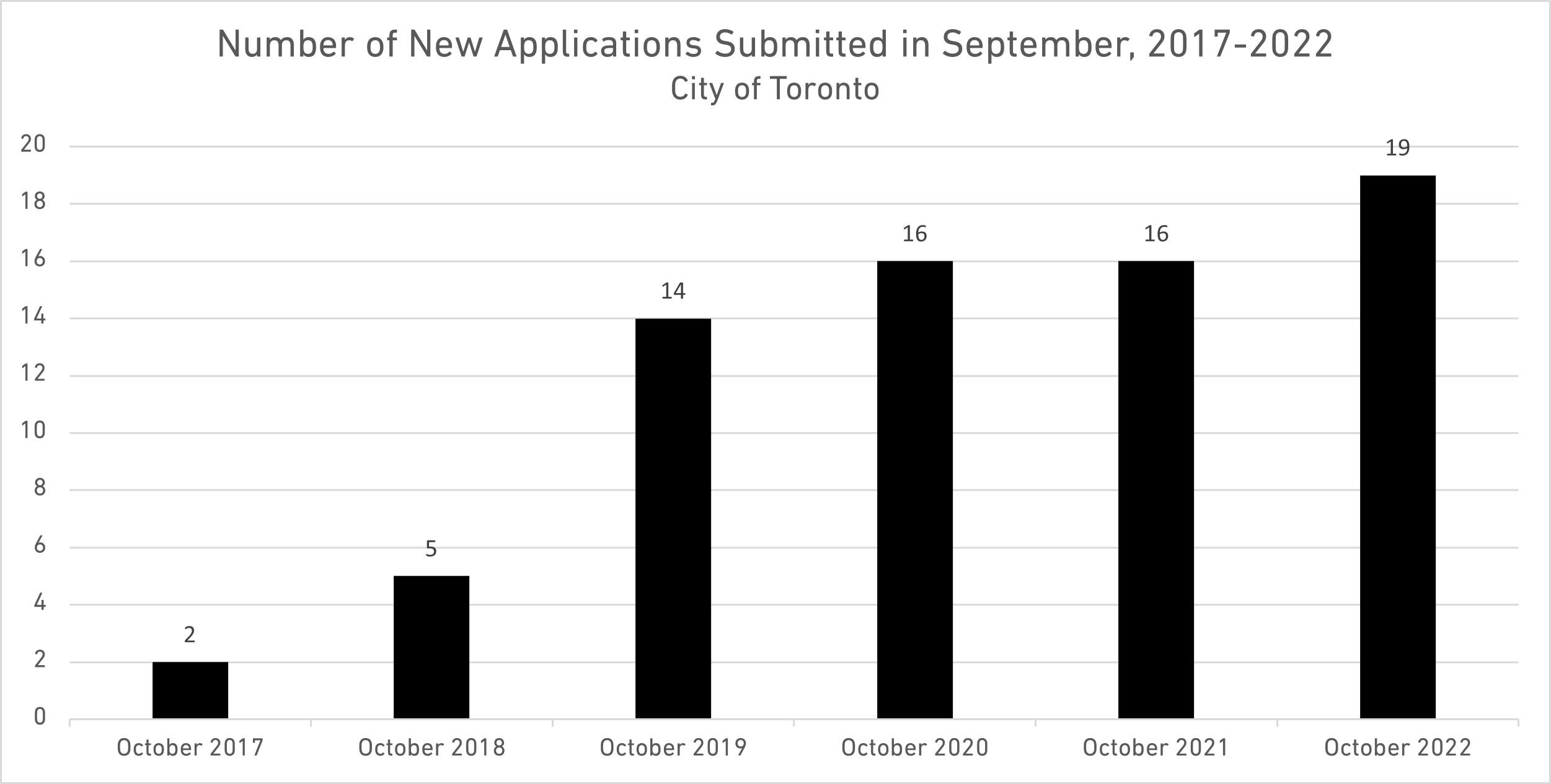

The new development numbers for October, 2022 when compared to those from October, 2021, show a significant change. The total number of applications has increased from 15 to 19, a 27% increase. This indicates that more developers are showing interest in building structures in the City of Toronto.

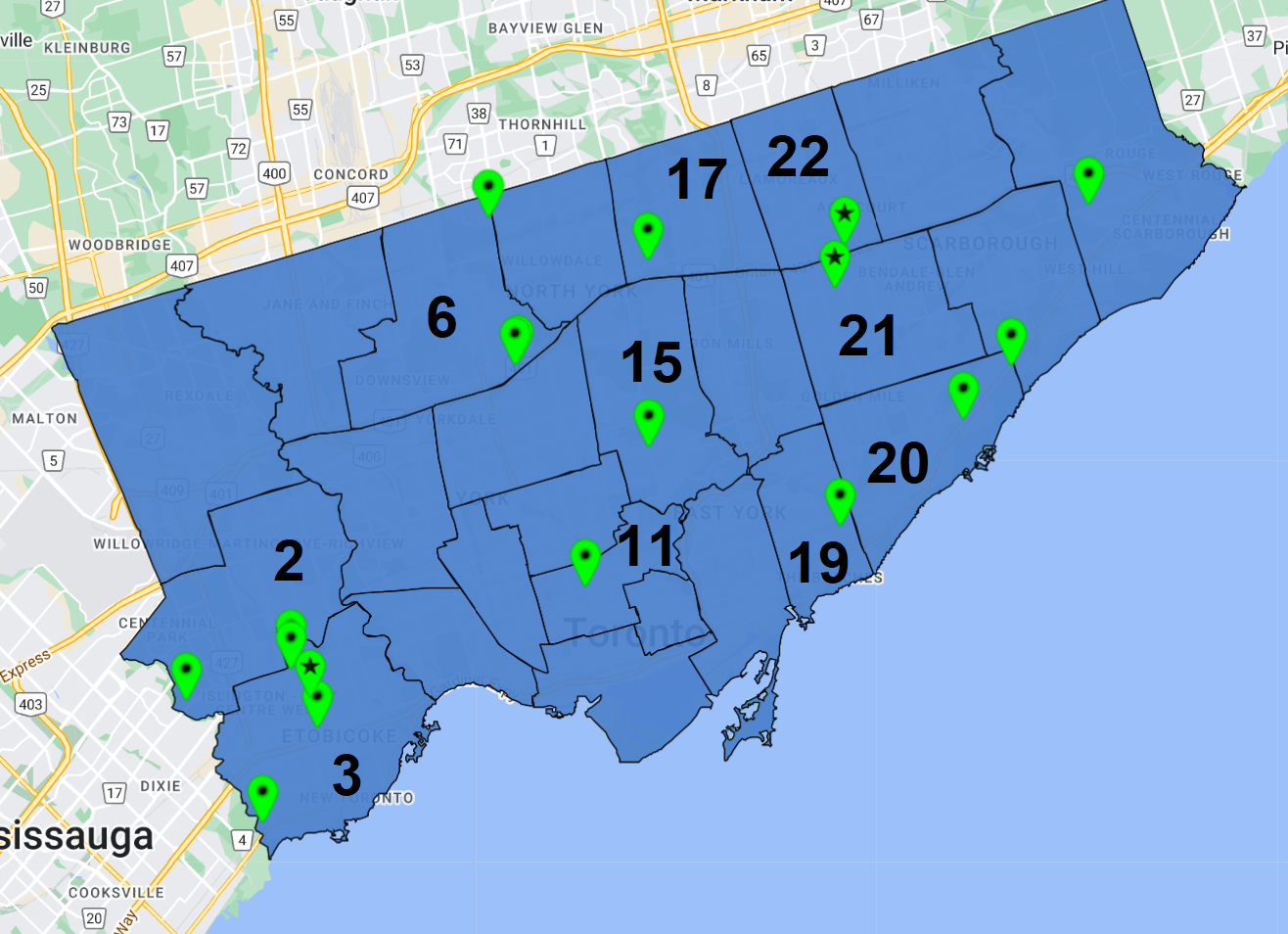

Map of new development applications submitted in October, 2022, by Toronto Ward. Data from UrbanToronto

Map of new development applications submitted in October, 2022, by Toronto Ward. Data from UrbanToronto

Furthermore, 29 buildings were proposed in October, 2022, as opposed to 21 proposed in October, 2021 - a 38% increase. The total number of parking spots has also increased from 1,936 to 2,373 (23%).

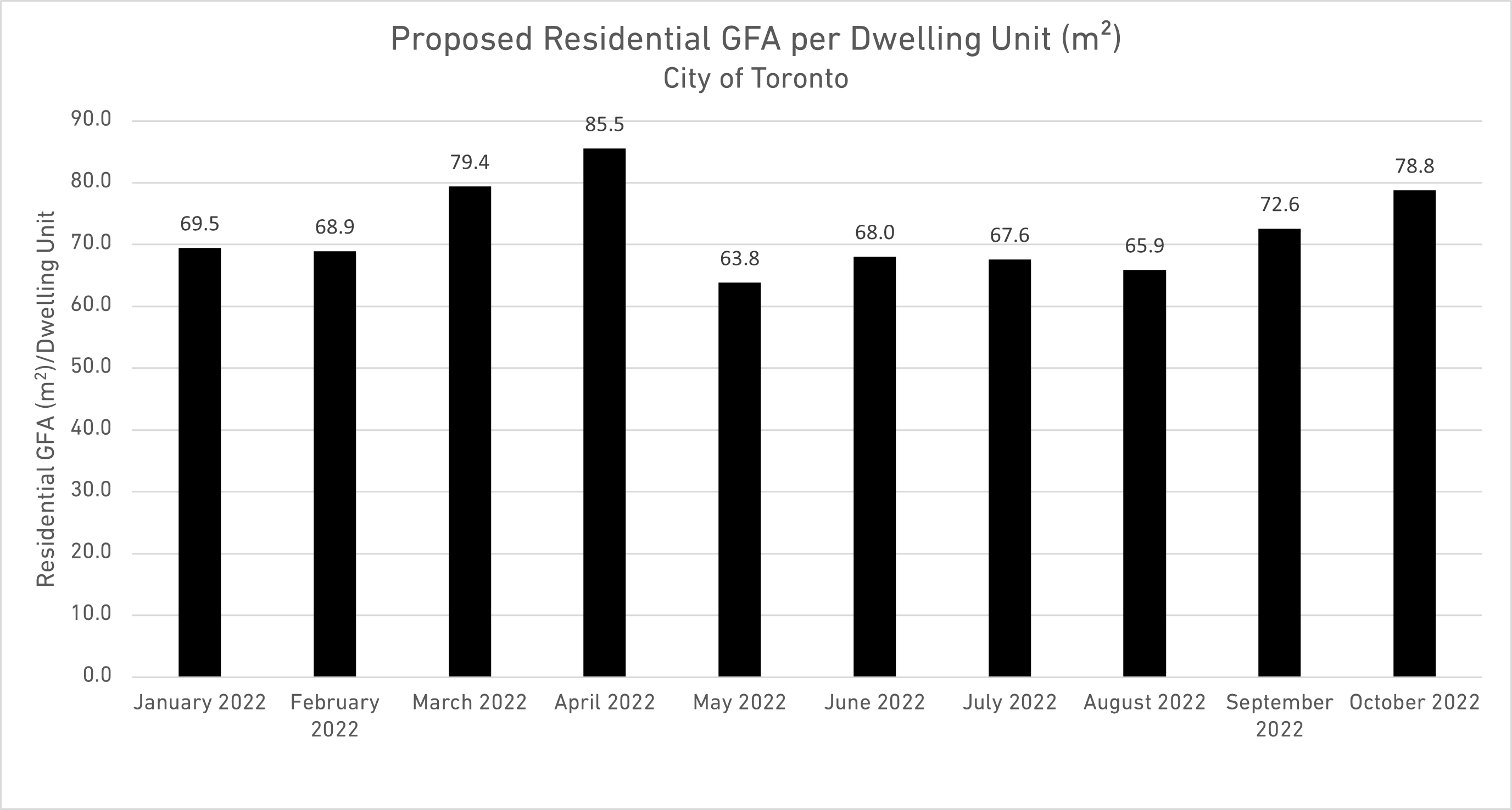

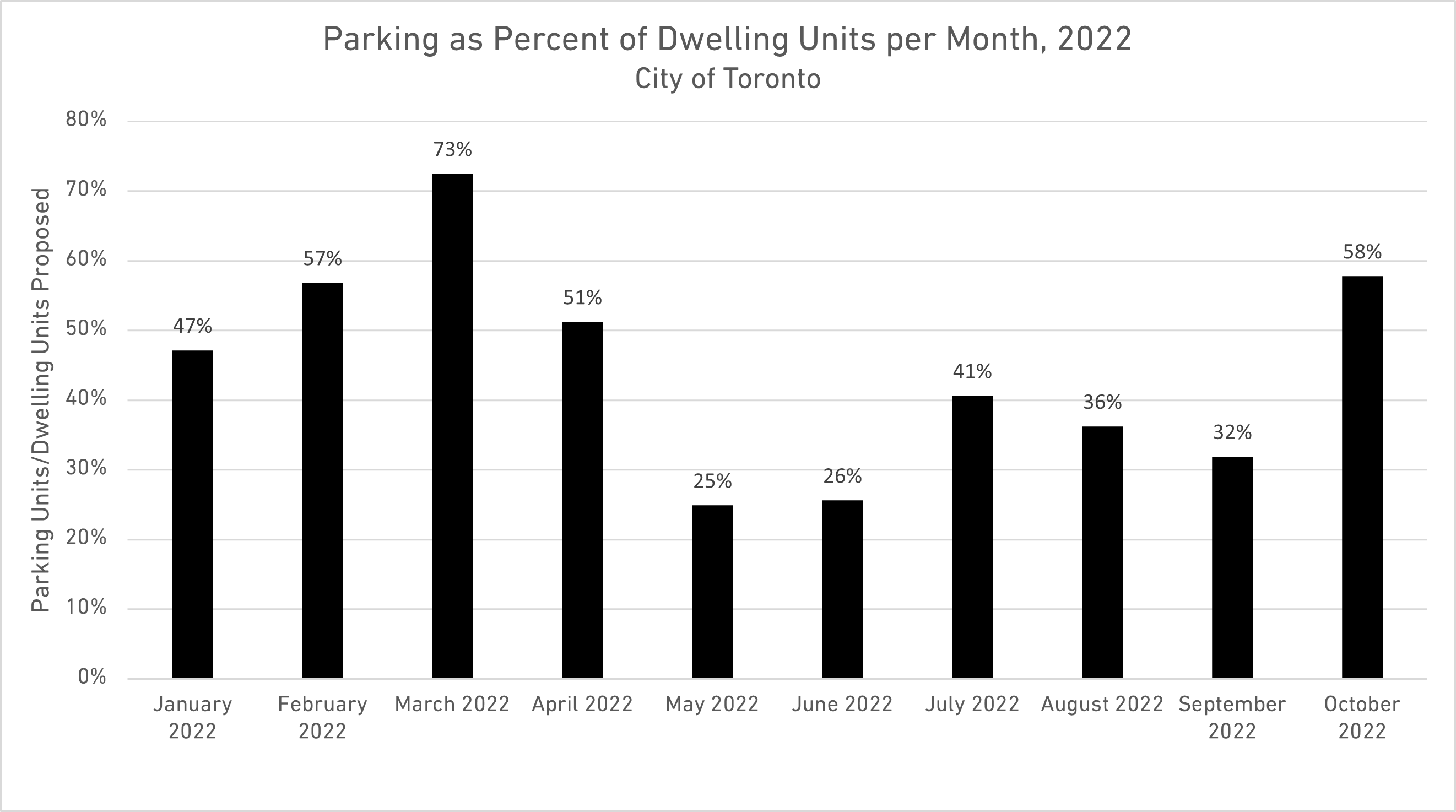

The proposed dwelling units for October, 2022 have decreased when compared to October, 2021. This October, 4,125 new dwelling units were proposed while 5,940 were proposed in the previous October (31% decrease). However, the total parking proposed per dwelling unit has decreased from 0.59 per unit in October, 2021 to 0.57 per unit this month (for those who wish to see fewer parking spots in the city, this is a 3% improvement).

Otherwise, we saw an improvement in residential GFA proposed per dwelling unit, from 791 ft² in October, 2021 to 848 ft² in October, 2022 (7% improvement).

The Gross Floor Area proposed has decreased from 5.6 million ft² to 3.9 million ft², while the Site Area proposed has decreased from 2.1 million ft² to 1.5 million ft² - indicating a decrease of 30% and 29%. The Floor Space Index ratio has also dropped slightly from 2.67 in September 2021 to 2.61 this month (2% decrease).

Overall, the new development figures for October, 2022 indicate a general trend towards improved efficiency, with improvements seen in some areas but decreases in others when compared to those proposed during last month's period. This could be attributed to the increasing interest of developers as well as an effort towards more efficient use of space.

These numbers show the potential for continued growth in the urban development industry and could be a sign of more opportunities to come in the near future.

If you want to track all of this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UTPro.

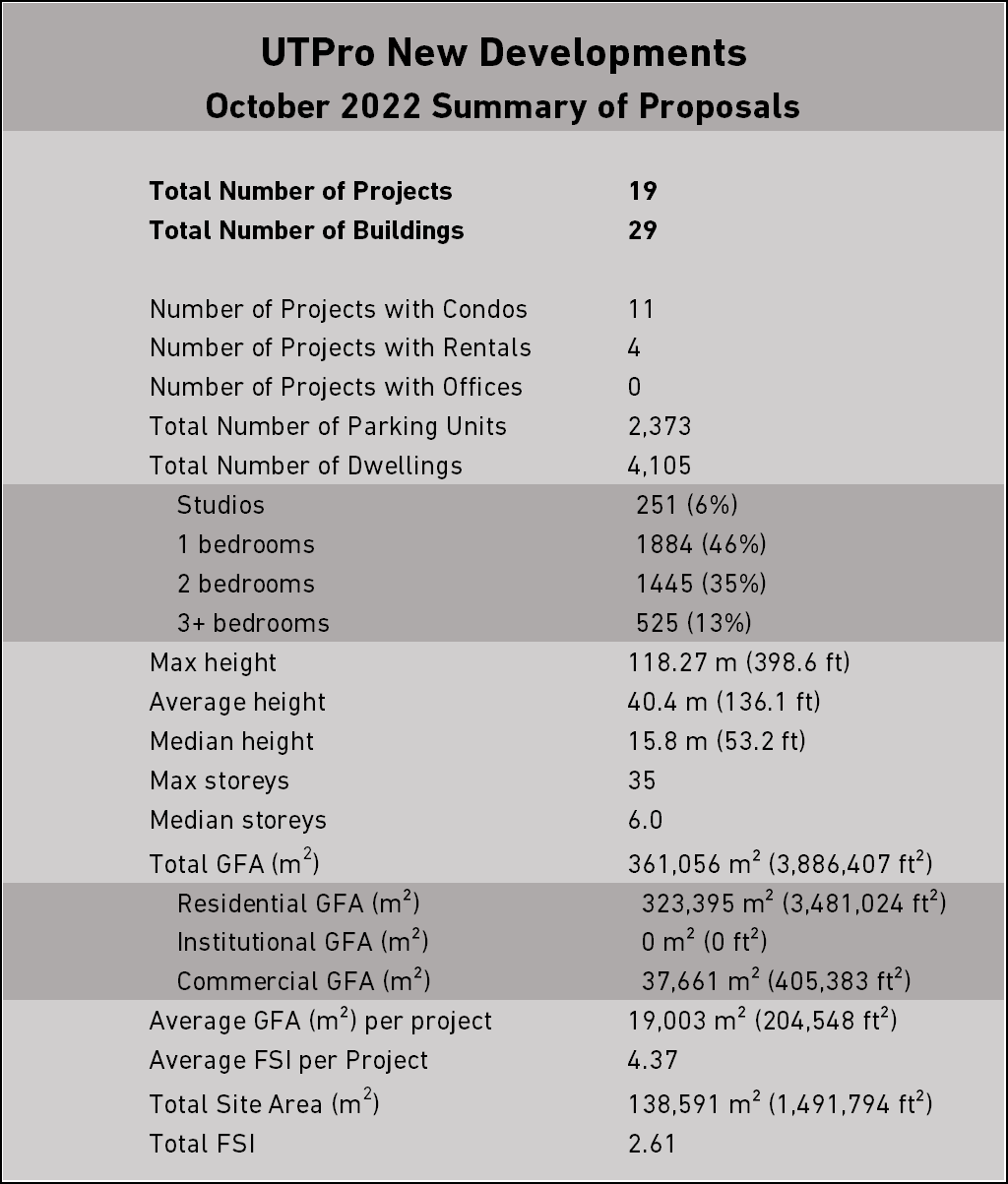

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UrbanToronto..

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UrbanToronto..

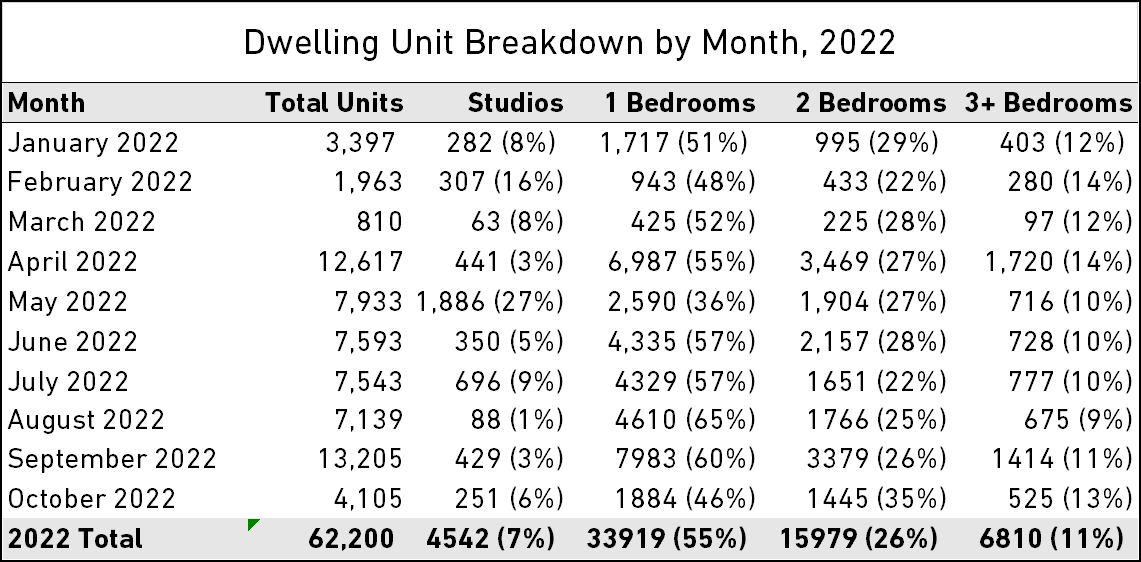

Dwelling unit mix proposed, January to October 2022. Data from UrbanToronto.

Dwelling unit mix proposed, January to October 2022. Data from UrbanToronto.

The total Floor Space Index (Total GFA divided Total Site Area) proposed in 2022, by month. Data from UTPro.

The total Floor Space Index (Total GFA divided Total Site Area) proposed in 2022, by month. Data from UTPro.

New major development proposals submitted in the month of October, from 2017 to 2022.

New major development proposals submitted in the month of October, from 2017 to 2022.

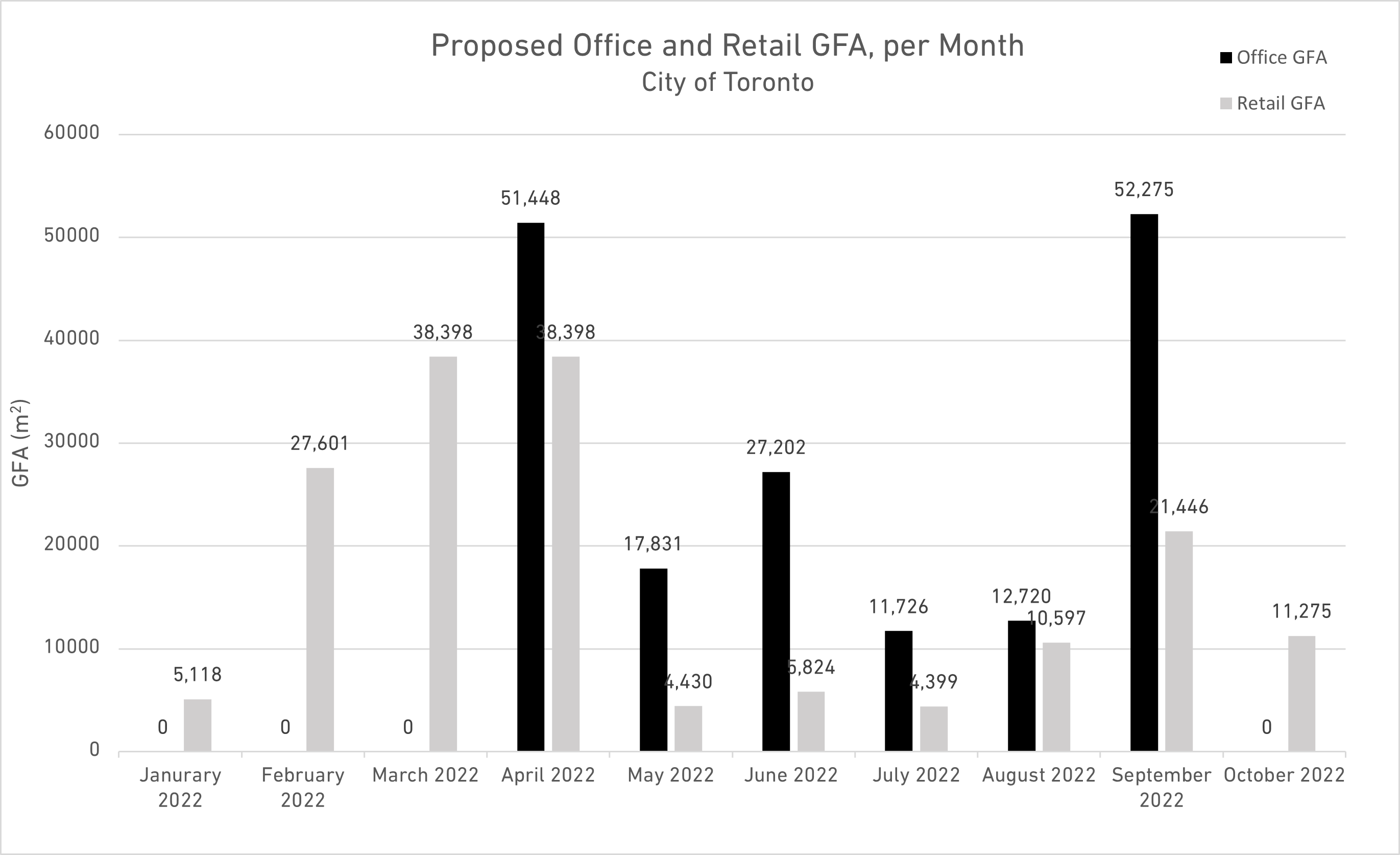

Comparison of proposed office and retail GFA to the City of Toronto in the month of October 2022. Data from UrbanToronto Pro.

Comparison of proposed office and retail GFA to the City of Toronto in the month of October 2022. Data from UrbanToronto Pro.

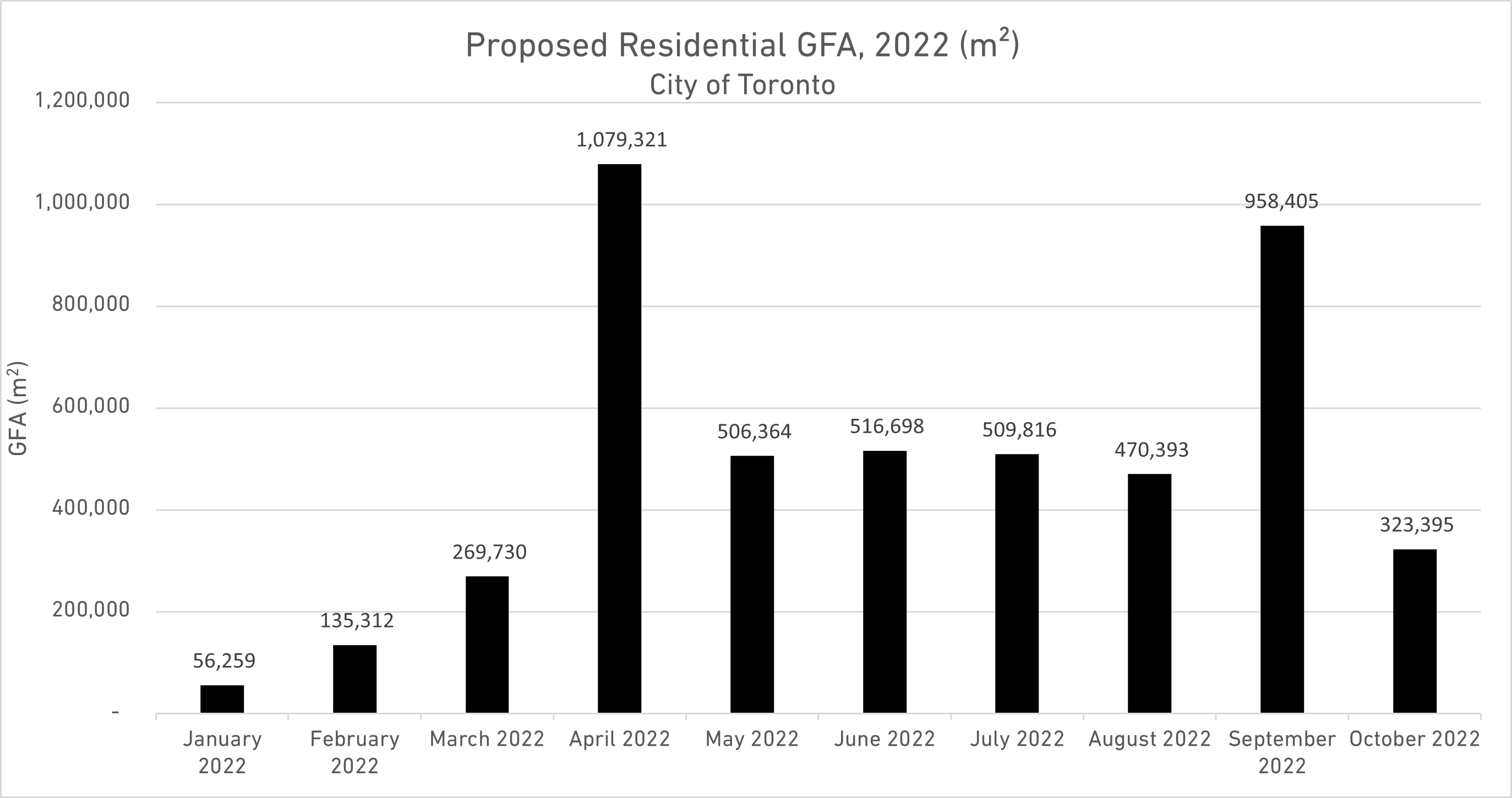

Total Residential GFA proposed per month, as submitted to the City of Toronto, January to October 2022. Data from UrbanToronto.

Total Residential GFA proposed per month, as submitted to the City of Toronto, January to October 2022. Data from UrbanToronto.

Residential GFA proposed per dwelling unit, as submitted to the City of Toronto, January to October 2022. Data from UrbanToronto.

Residential GFA proposed per dwelling unit, as submitted to the City of Toronto, January to October 2022. Data from UrbanToronto.

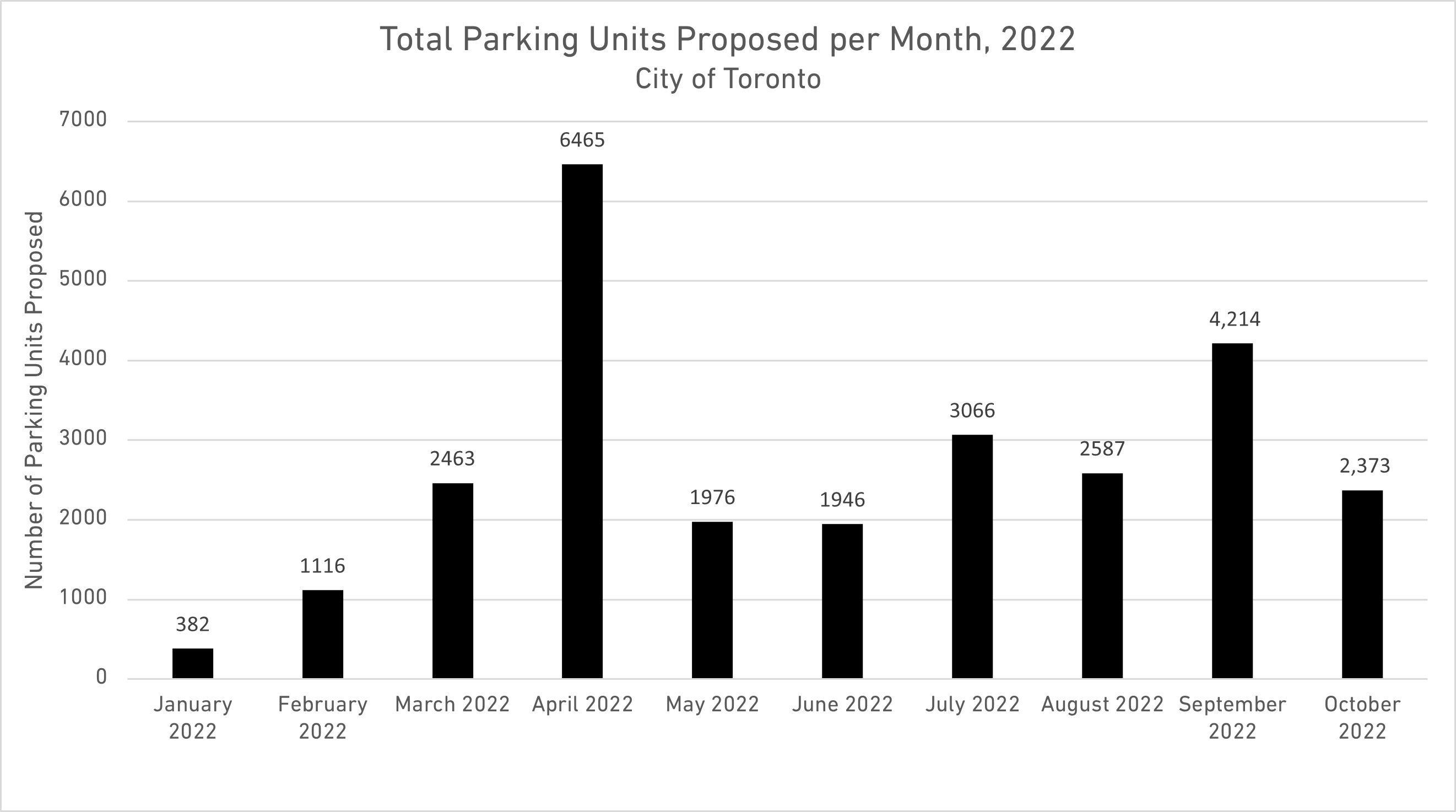

Total Parking Units proposed per month, January to October 2022. Data from UrbanToronto.

Total Parking Units proposed per month, January to October 2022. Data from UrbanToronto.

Ratio of proposed parking units per dwelling, by month in 2022. Data from UrbanToronto.

Ratio of proposed parking units per dwelling, by month in 2022. Data from UrbanToronto.

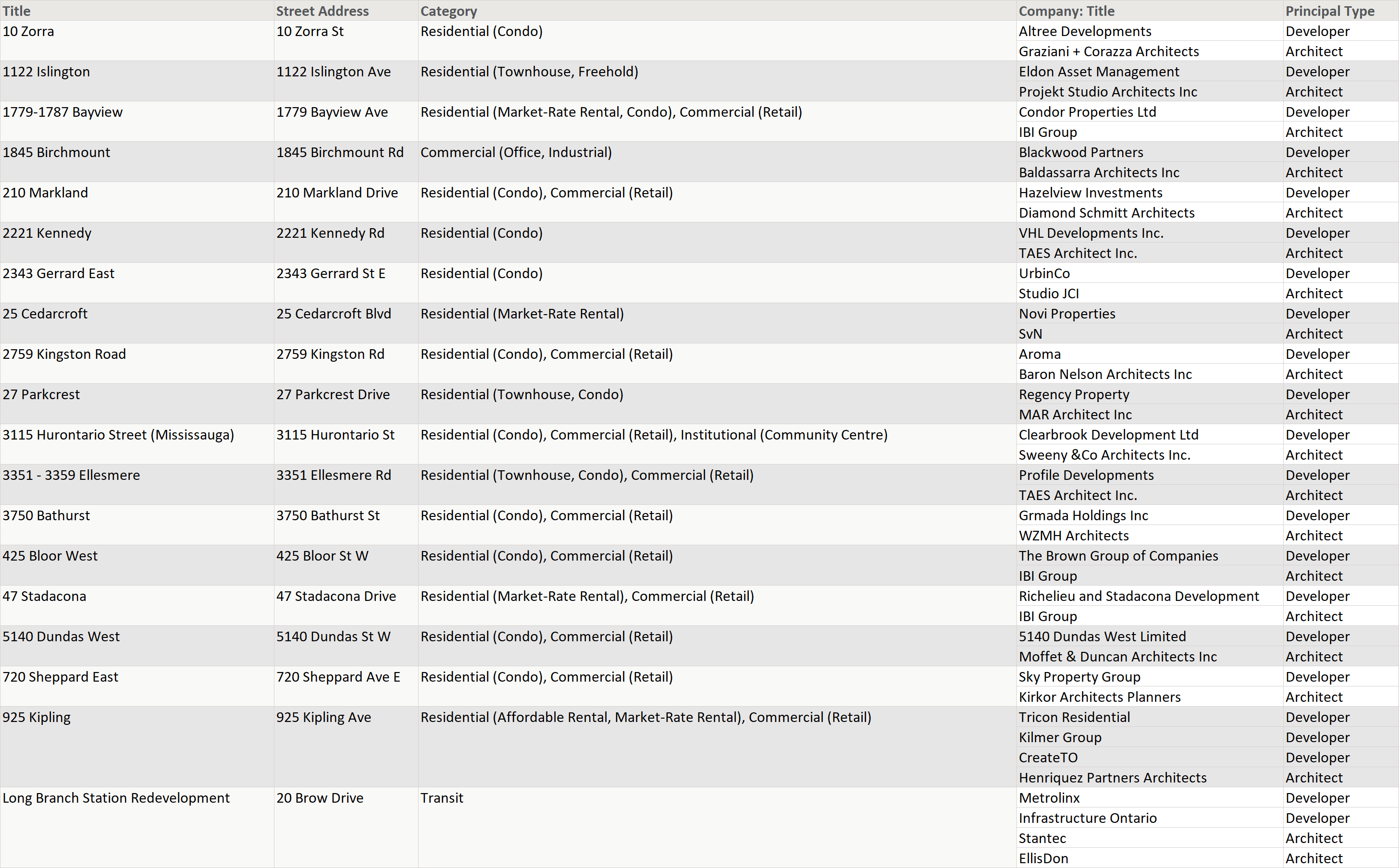

Developers and architects for projects submitted in October, 2022. We have records of over 200 principals involved in these projects.

Developers and architects for projects submitted in October, 2022. We have records of over 200 principals involved in these projects.

***

UTPro is UrbanToronto's premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a "large project" as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

2.6K

2.6K