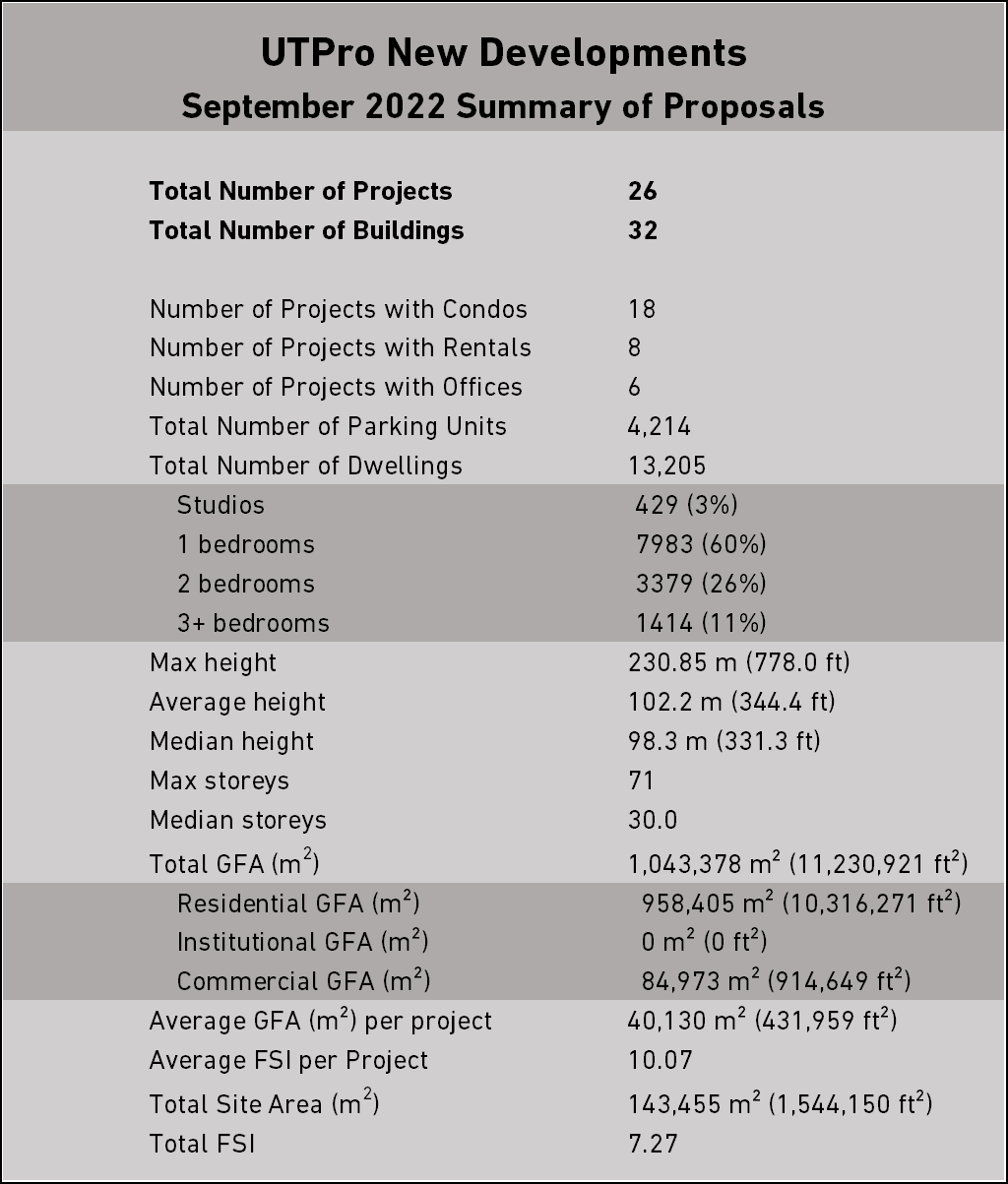

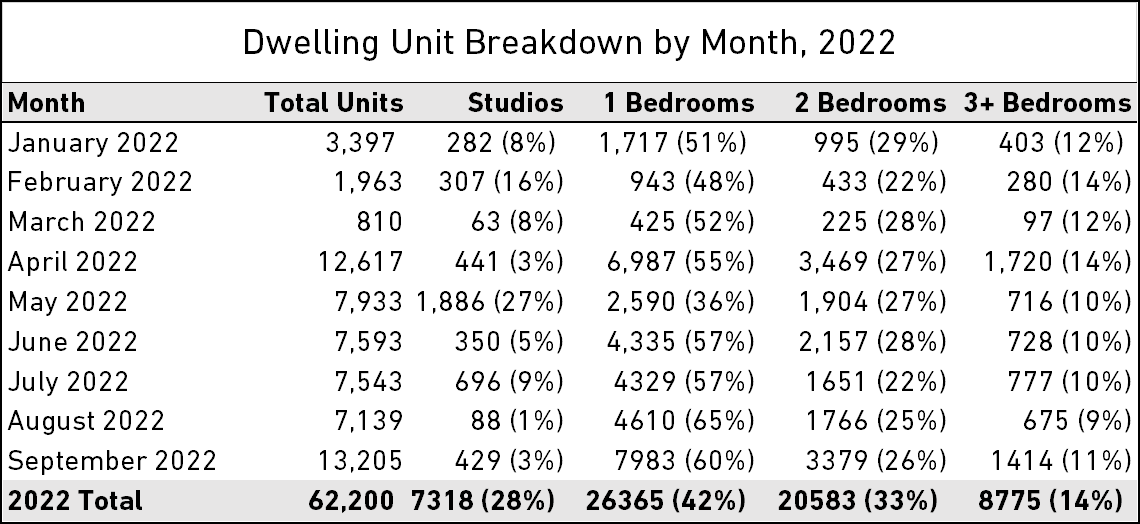

Recent reports from real estate analysts have revealed that sales and transactions for new homes have plummeted to historic lows. While some would expect that this would mean development proposals would similarly be crashing, data from UrbanToronto's Pro service reveals a different story. In September of this year, there were 26 applications for new development, as opposed to 16 in the same month of last year. Moreover, the number of new dwelling units proposed increased from 5,255 last year to 13,205 – a 150% increase. So, while consumers seems to be cooling down, developers seem to be turning up the heat.

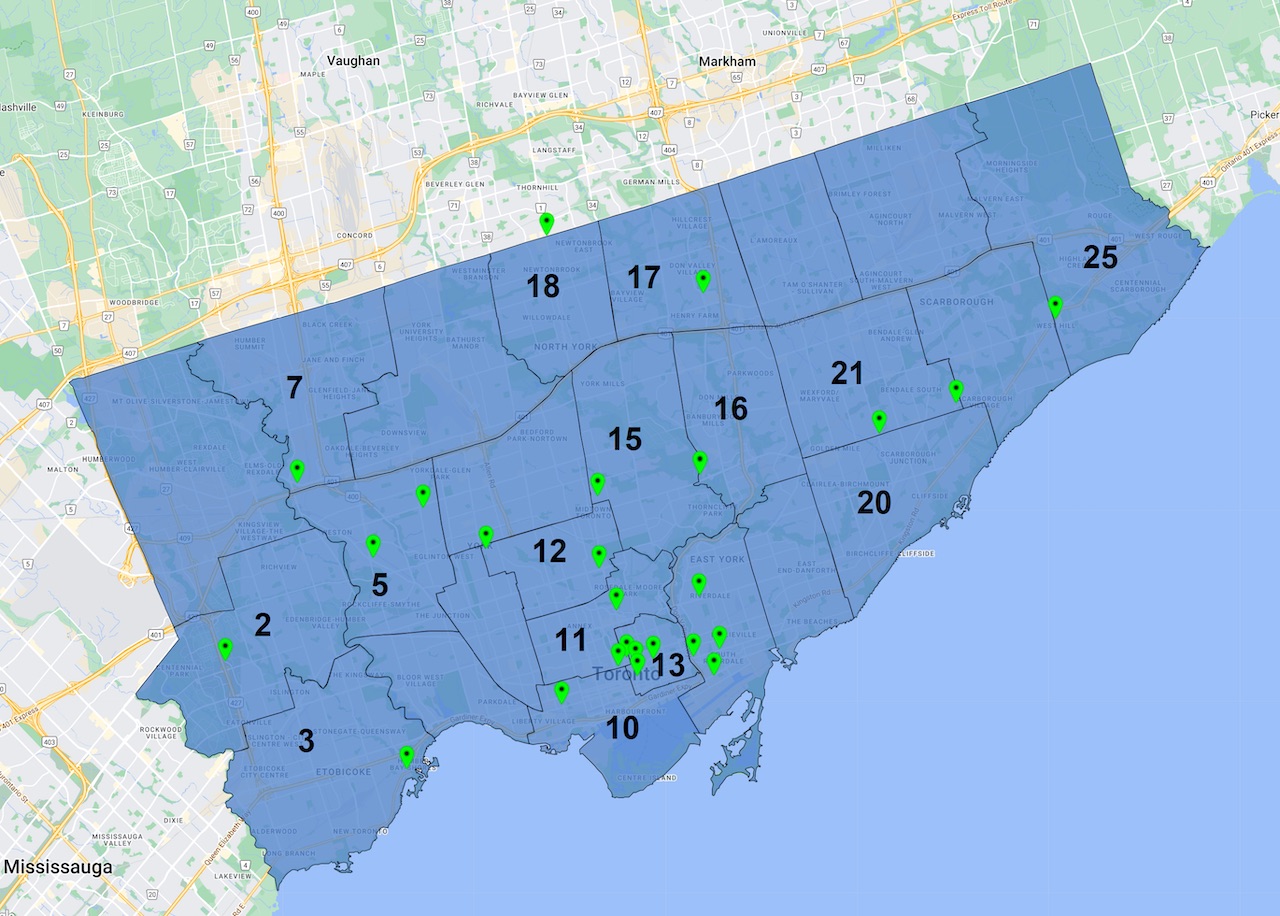

Map of new development applications submitted in September, 2022, by Toronto Ward. Data from UrbanToronto

Map of new development applications submitted in September, 2022, by Toronto Ward. Data from UrbanToronto

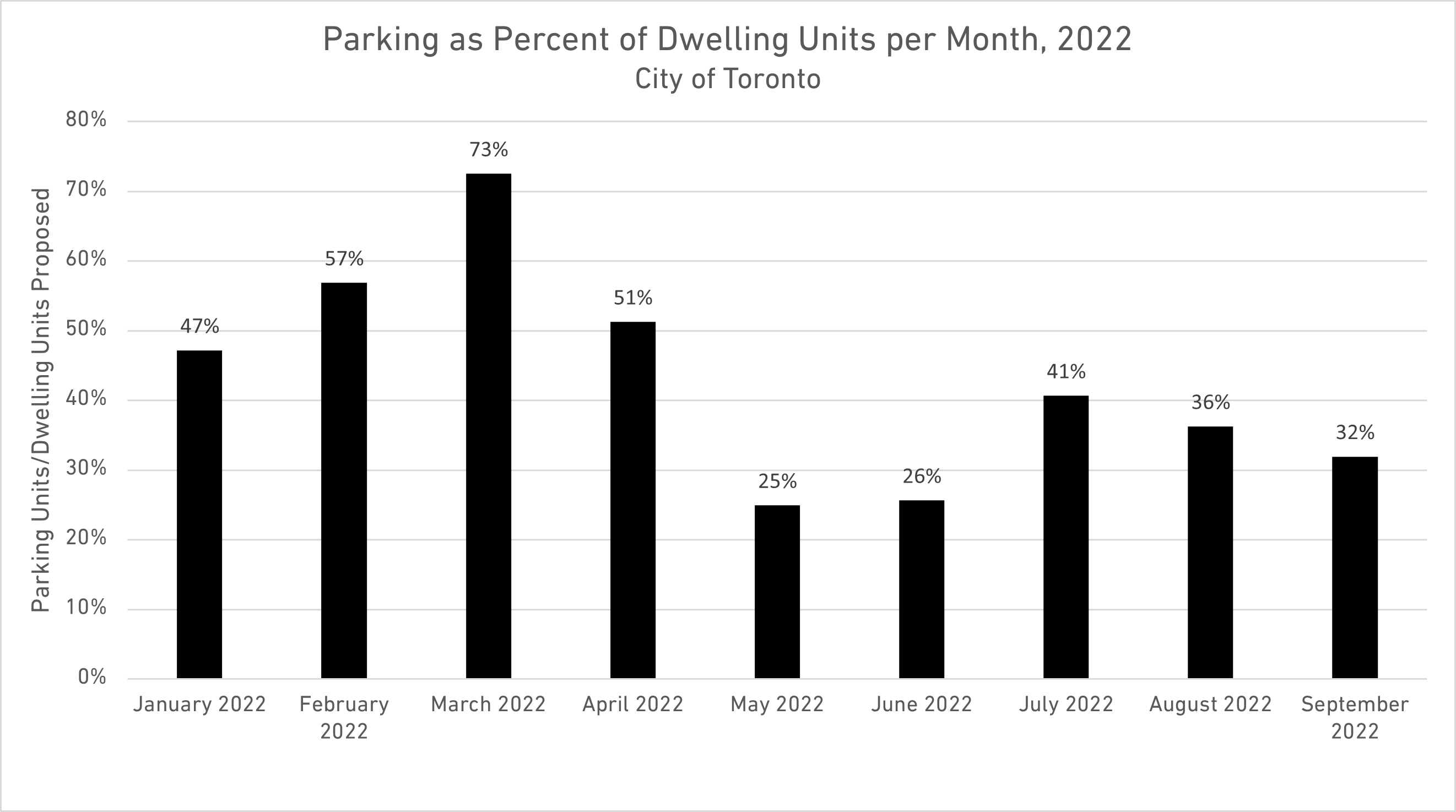

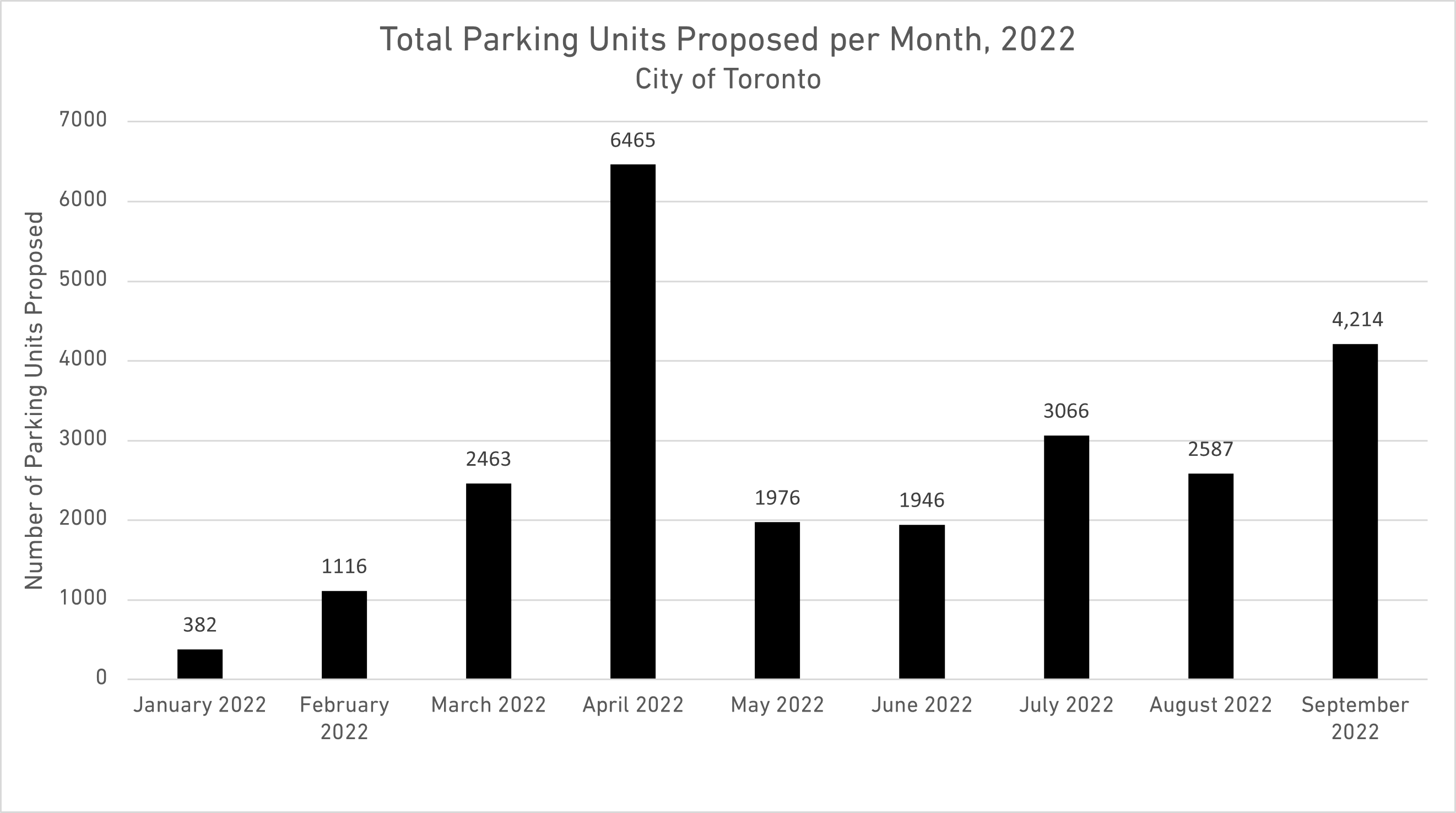

While there was an overall increase in new proposals, there were some decreases in specific categories. In particular, the number of new parking spots proposed this year decreased 20% compared to last year. There was also a significant decline in the ratio of parking units per dwelling: from 0.75 to 0.32. This continues the trend from previous months, as minimum parking requirements were virtually eliminated city-wide.

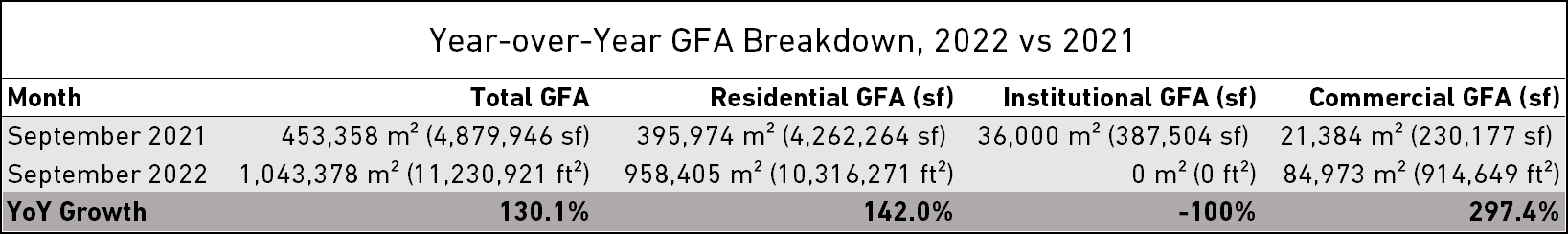

While the overall amount of Gross Floor Area (GFA) proposed this year is much greater than it was last year (an increase of 130%), the residential GFA per dwelling shrank, from 811 sf to 781 sf. This implies much less "living area" per unit. Smaller units, however, address affordability concerns by two virtues: first, in an environment of high prices per square feet, fewer square feet means a lower price for the unit. Second, developers can fit more units in the same building, increasing supply. The increase in supply, in turn, lowers price pressure overall in the housing market, as essentially there are more options for home buyers (and eventually renters) to choose from.

In summary, developers are proposing more projects, more units, but less space per unit. There are two possible interpretations of these numbers. First, is that it appears that developers are displaying more confidence in the future of city than home buyers. Although expectations that the 100,000 people on average who move to the GTA every year will continue unabated (as, despite current blips, Canada and Toronto are seen internationally as a secure, safe haven for both newcomers and investors), domestic home buyers are struggling in the current economic environment. High interest rates and increasing unemployment increase the costs and risks of buying a home in the short-term.

Developers face different, but still similar constraints to individual buyers. They must put up more collateral for loans, have to navigate the lengthy planning process, and also face uncertainty with respect to future construction costs. So it is perhaps even more surprising that developers are more optimistic than ordinary home buyers.

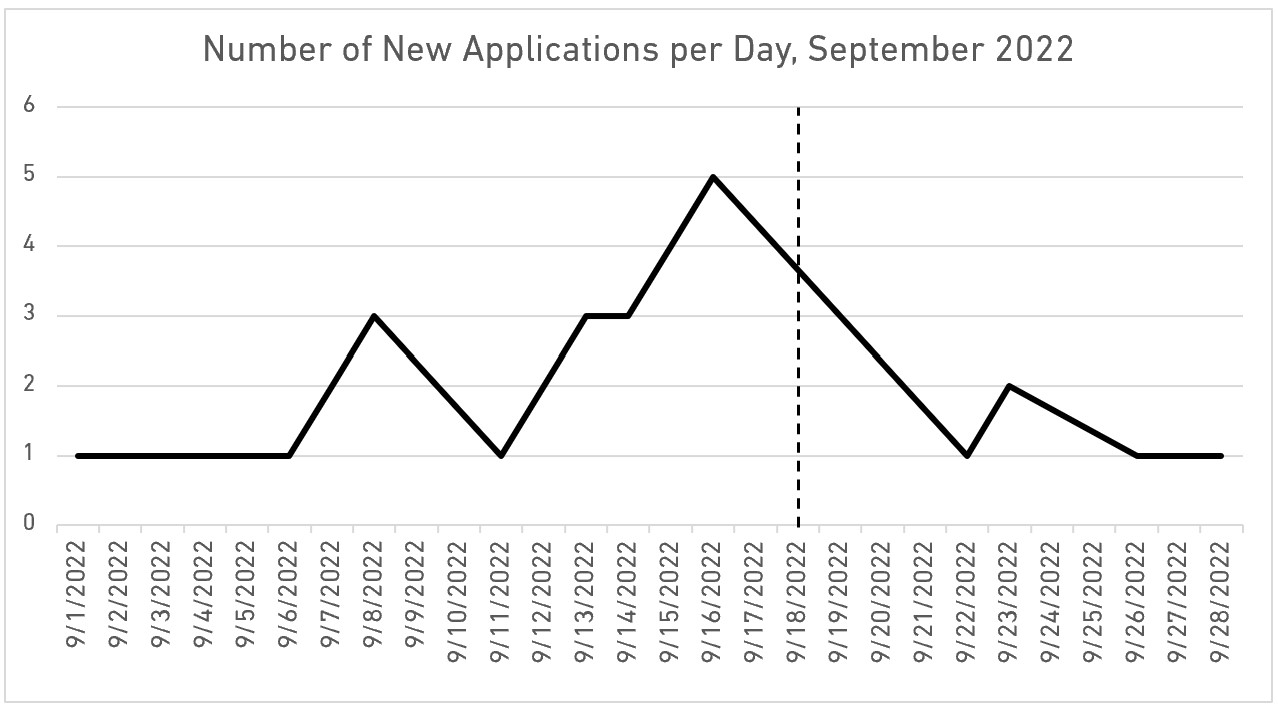

However, there is a second possible explanation for the increase in development applications this month: Inclusionary Zoning. Although initially passed by City Council in December of last year, the actual deadline for exemptions to the bylaw was in fact on September 18th. The original vote in December caused a huge rush of applications in the lead-up to the vote, perhaps due to some confusion about what the new law would be in effect. It turned out that any completed application submitted on or before September 18th, 2022, would be exempt from the new bylaw. And in fact, we saw a sudden increase in applications leading up to this new deadline.

New Rezoning, OPA, and Site Plan Applications Submitted Per Day, September 2022. Vertical Bar is Cutoff Date for Inclusionary Zoning. Data from UrbanToronto.

New Rezoning, OPA, and Site Plan Applications Submitted Per Day, September 2022. Vertical Bar is Cutoff Date for Inclusionary Zoning. Data from UrbanToronto.

Putting together a complete application can take many months. But if developers are so concerned about meeting a deadline that it causes not one, but two giant waves of applications, it must mean developer confidence in their ability to do deliver profitable projects under the City's IZ rules may be low. (With the new More Homes, Built Faster Act, introduced on October 25th, may in fact nullify the City's IZ bylaw. But as the Provincial bill is still in consultation, this remains to be seen.)

Whatever the reason for developer confidence, this data is important for understanding current trends and issues facing cities like Toronto. By providing insights into new development proposals, we can better understand the drivers of growth and plan accordingly to accommodate future population increases.

Overall, it seems that September 2022 was a pivotal month in the city's development landscape. Whether this signals an upward trend or a temporary blip remains to be seen, but it is clear that developers see opportunities in the city and are moving quickly to capitalize on them.

If you want to track all of this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UTPro.

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UrbanToronto..

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UrbanToronto..

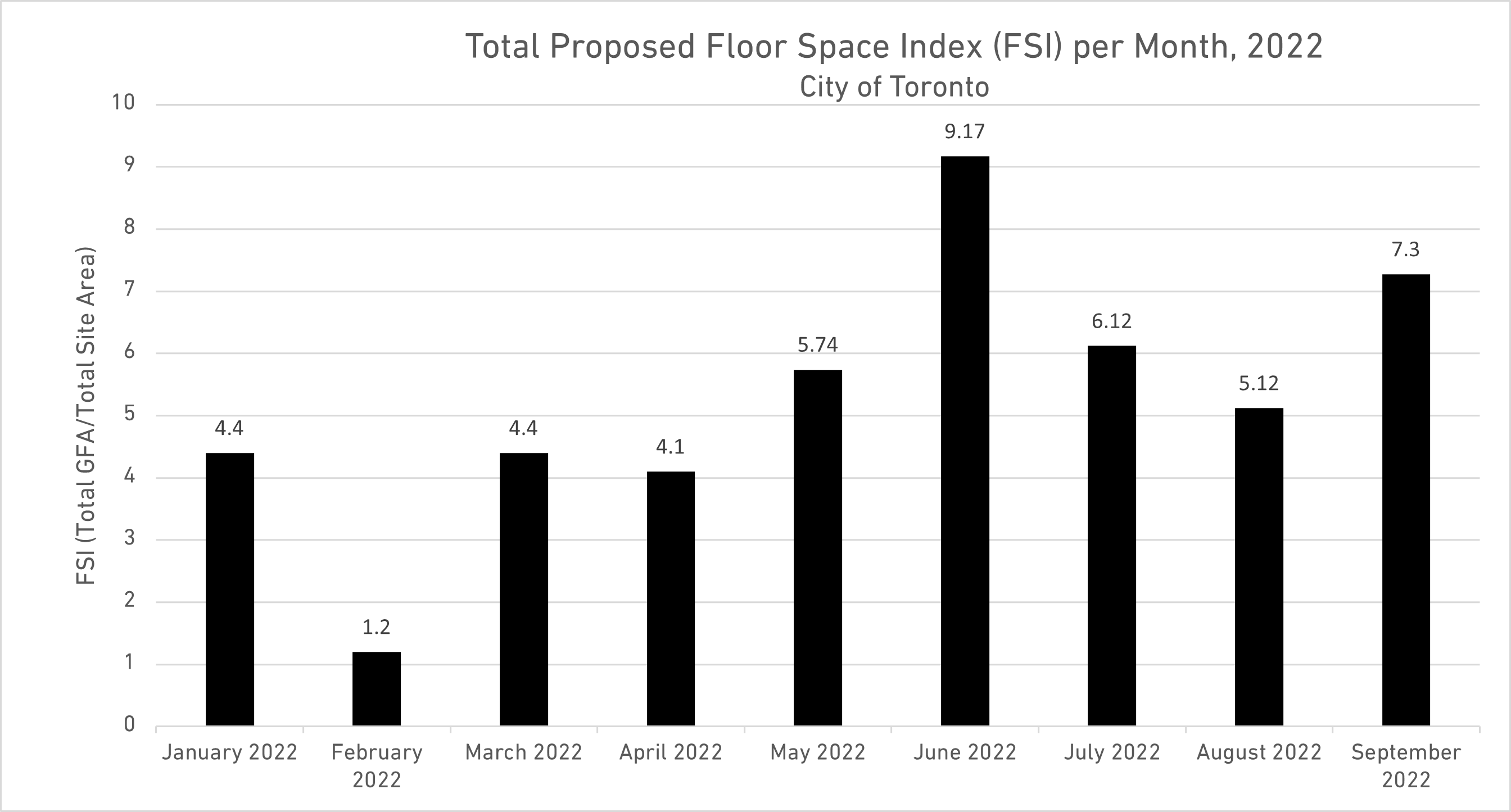

The total Floor Space Index (Total GFA divided Total Site Area) proposed in September, from 2017 to 2022. Data from UTPro.

The total Floor Space Index (Total GFA divided Total Site Area) proposed in September, from 2017 to 2022. Data from UTPro.

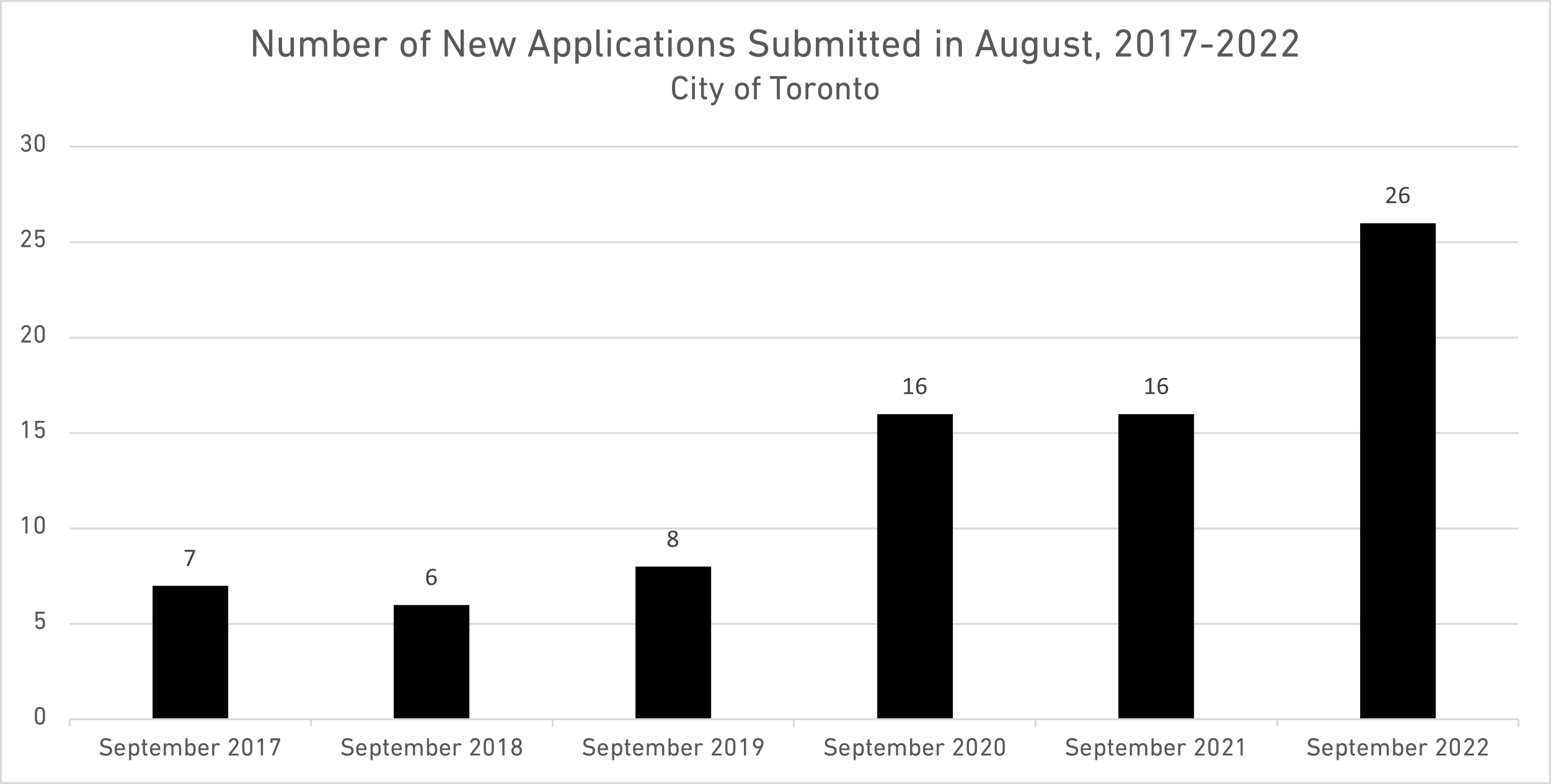

New major development proposals submitted in the month of September, from 2017 to 2022.

New major development proposals submitted in the month of September, from 2017 to 2022.

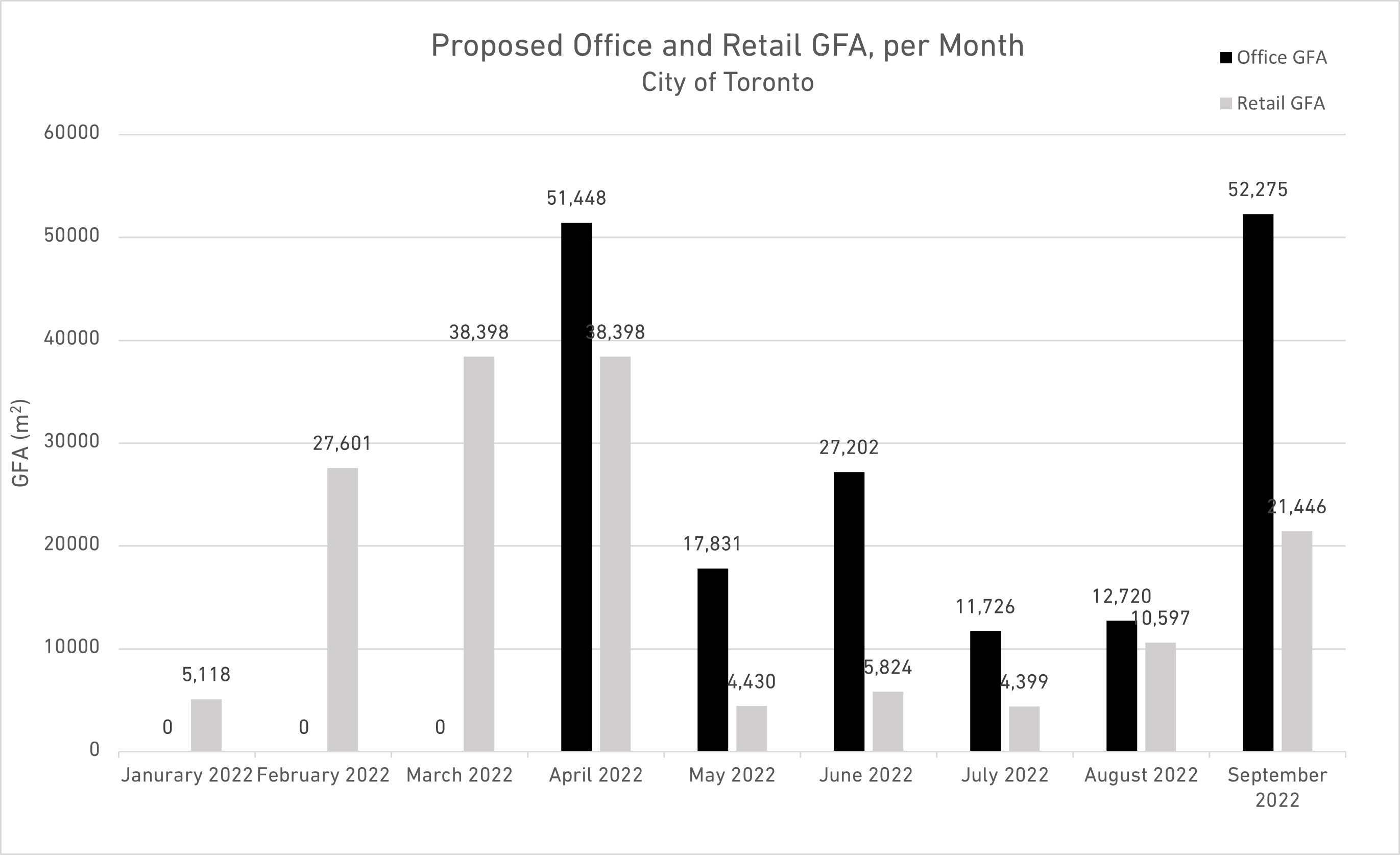

Comparison of proposed office and retail GFA to the City of Toronto in the month of September 2022. Data from UrbanToronto Pro.

Comparison of proposed office and retail GFA to the City of Toronto in the month of September 2022. Data from UrbanToronto Pro.

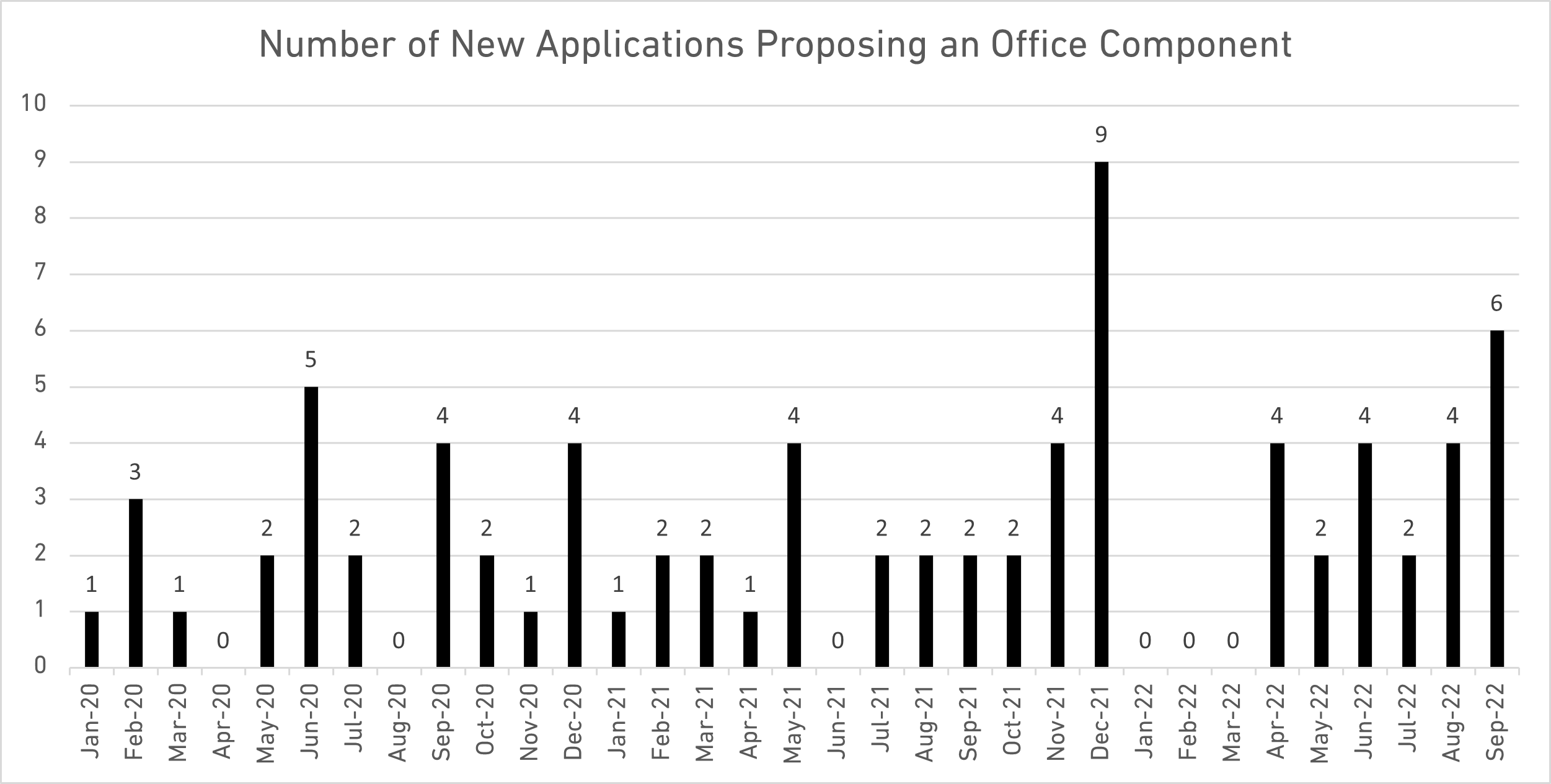

Number of projects with office GFA proposed per month, January 2020 to September 2022. Data from UrbanToronto.

Number of projects with office GFA proposed per month, January 2020 to September 2022. Data from UrbanToronto.

Ratio of proposed parking units per dwelling, by month in 2022. Data from UrbanToronto.

Ratio of proposed parking units per dwelling, by month in 2022. Data from UrbanToronto.

Total Parking Units proposed per month, January to September 2022. Data from UrbanToronto.

Total Parking Units proposed per month, January to September 2022. Data from UrbanToronto.

Dwelling unit mix proposed, January to September 2022. Data from UrbanToronto.

Dwelling unit mix proposed, January to September 2022. Data from UrbanToronto.

Breakdown of proposed GFA to the City of Toronto, September 2022 vs September 2021. Data from UrbanToronto.

Breakdown of proposed GFA to the City of Toronto, September 2022 vs September 2021. Data from UrbanToronto.

We also have data on nearly 300 companies working to bring these 26 projects to life. Here are the 46 developers and architects:

Architects and Developers for new applications submitted in September 2022. Data from UTPro.

Architects and Developers for new applications submitted in September 2022. Data from UTPro.

* * *

UTPro is UrbanToronto's premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a "large project" as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

3.2K

3.2K