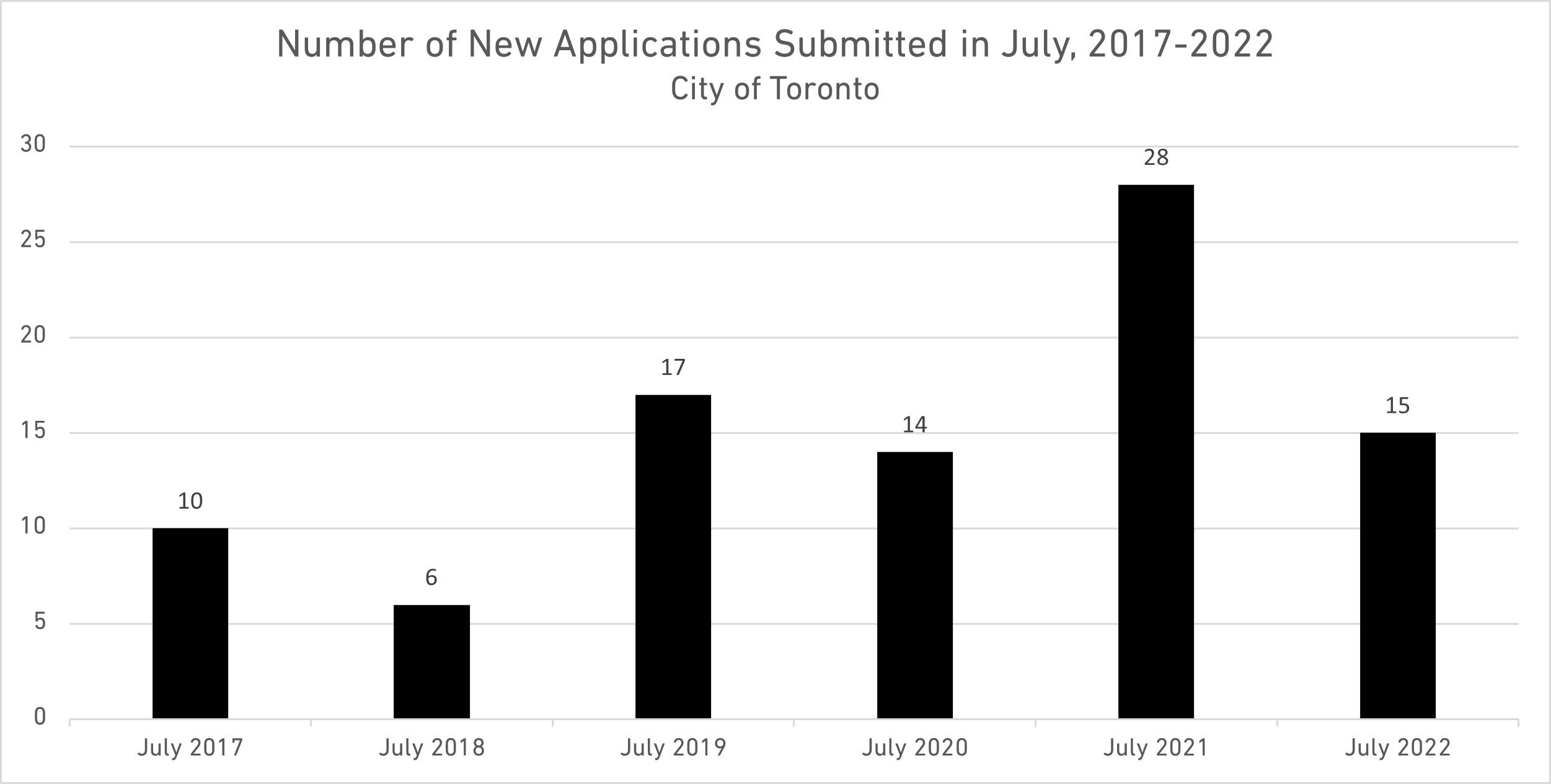

Against a backdrop of hawkish interest rate policy from the Bank of Canada, real estate developers submitted 15 applications for major projects to the City of Toronto in July of 2022. While the number of applications is comparable to previous years, a deeper dive into the numbers reveals some concerning weaknesses.

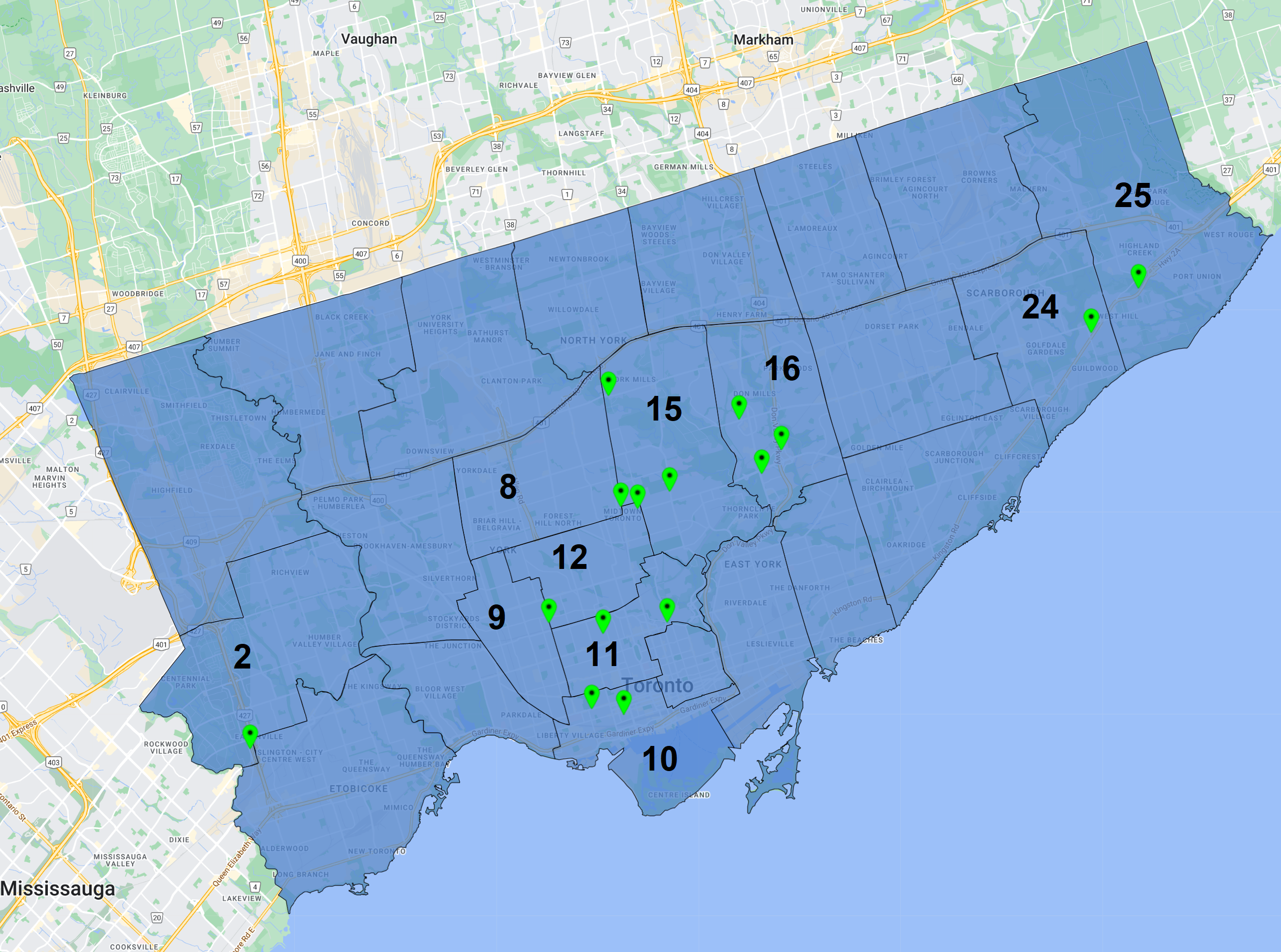

Map of new July 2022 applications, in Toronto Wards. Map and data from UrbanToronto Pro.

Map of new July 2022 applications, in Toronto Wards. Map and data from UrbanToronto Pro.

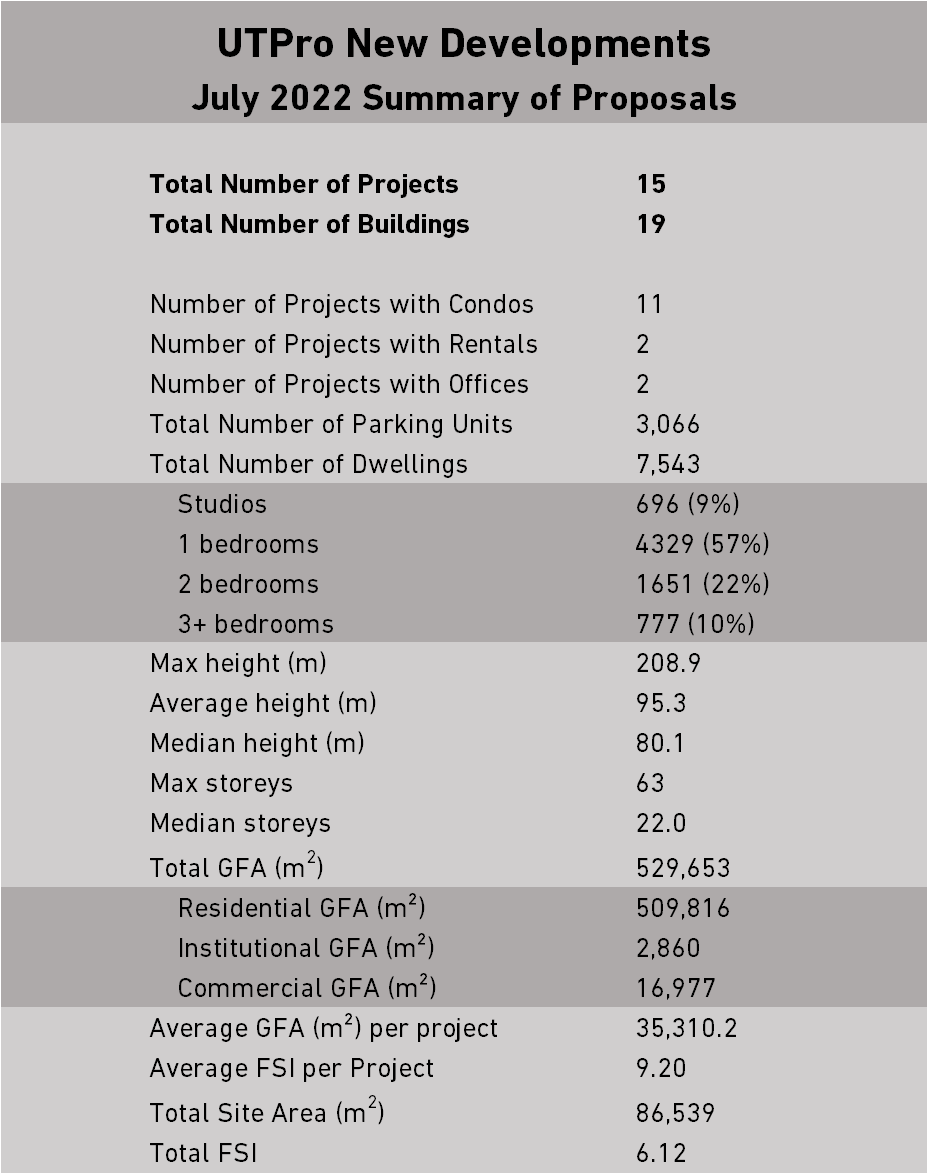

Developers are proposing to build 7,543 units and 19 buildings across 10 of Toronto’s Wards. This is comparable to June's 7,593 units, proposed across 32 buildings.

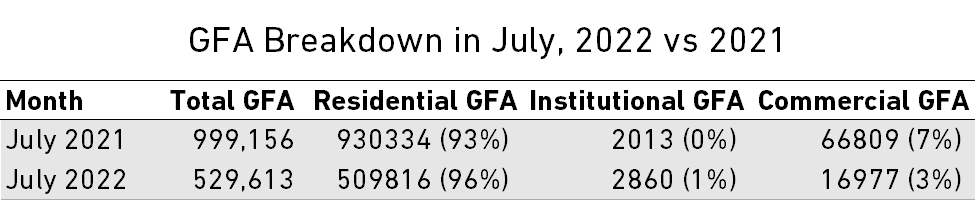

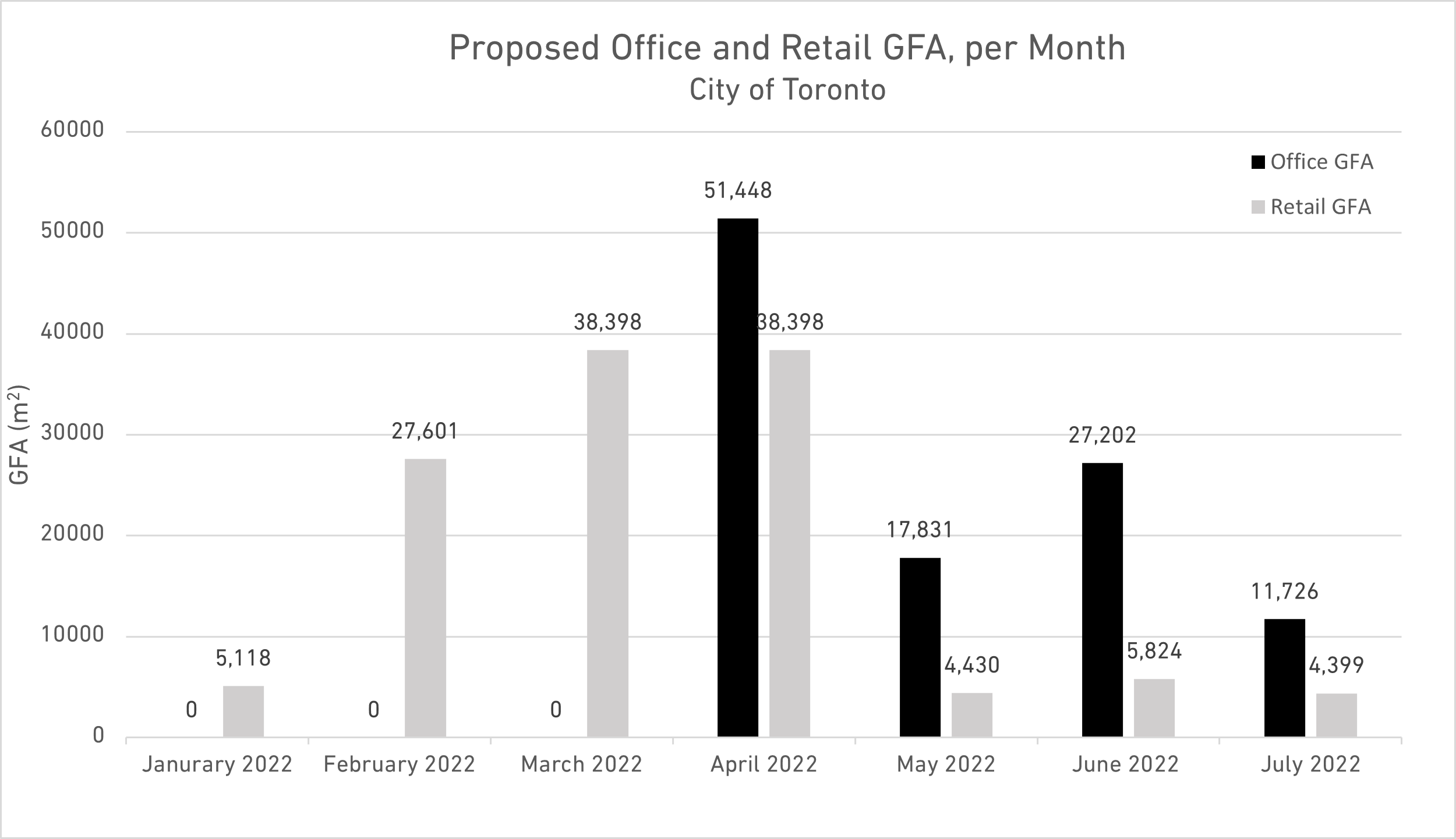

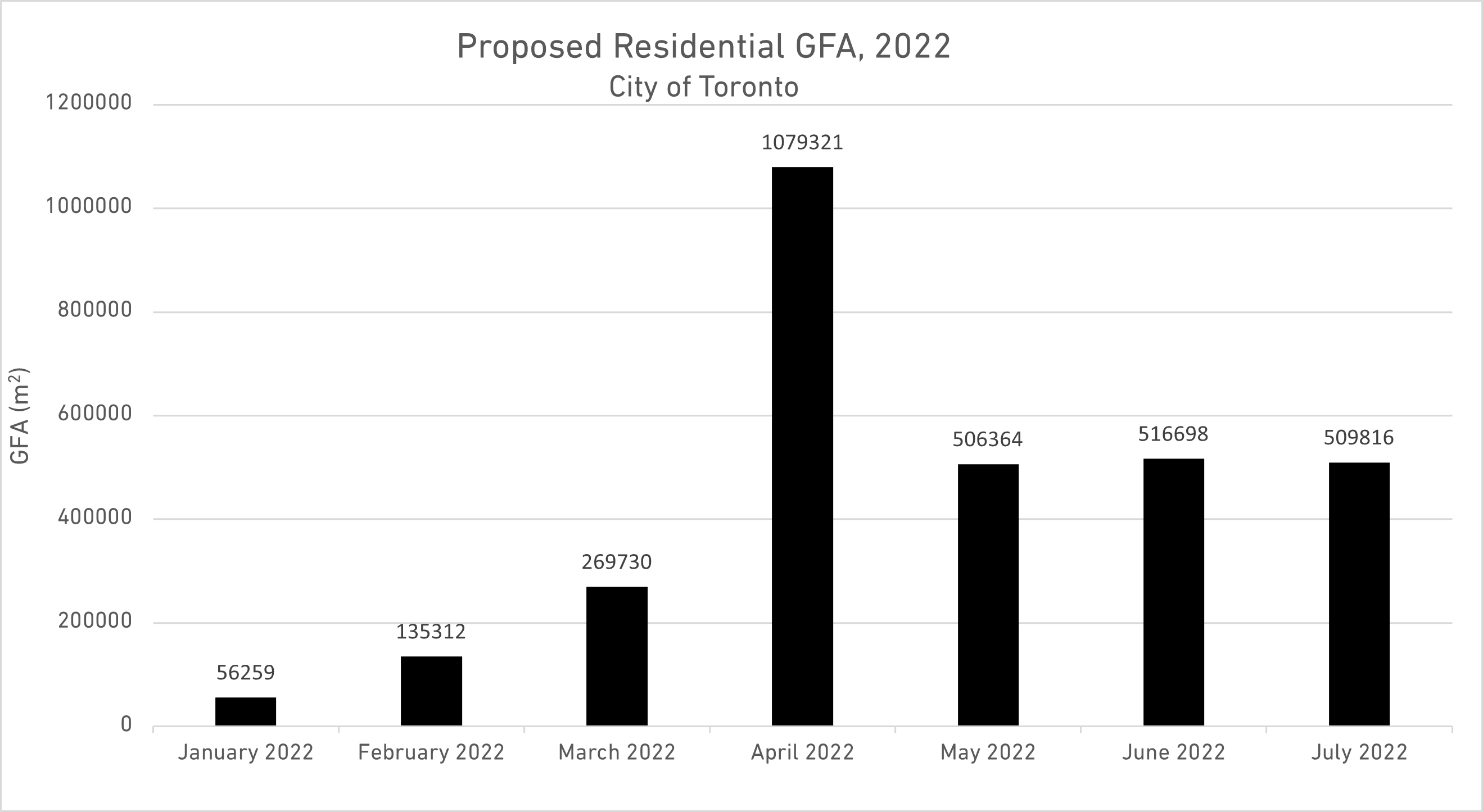

But the similarities end when this year’s numbers are compared to last year's. While July saw developers propose 529,653m² (about 5.7 million square-feet) of Gross Floor Area—roughly in line with last month’s numbers—this is a 47% drop compared to the 980,621m² (10.7 million ft²) of GFA proposed in July of 2021. The GFA mix was also markedly different. This year saw only 3% of all GFA proposed for commercial uses, which is less than half as much as the 7% proposed last year. This is indicative of lower confidence of future demand for commercial (office or brick-and-mortar retail) spaces in the city.

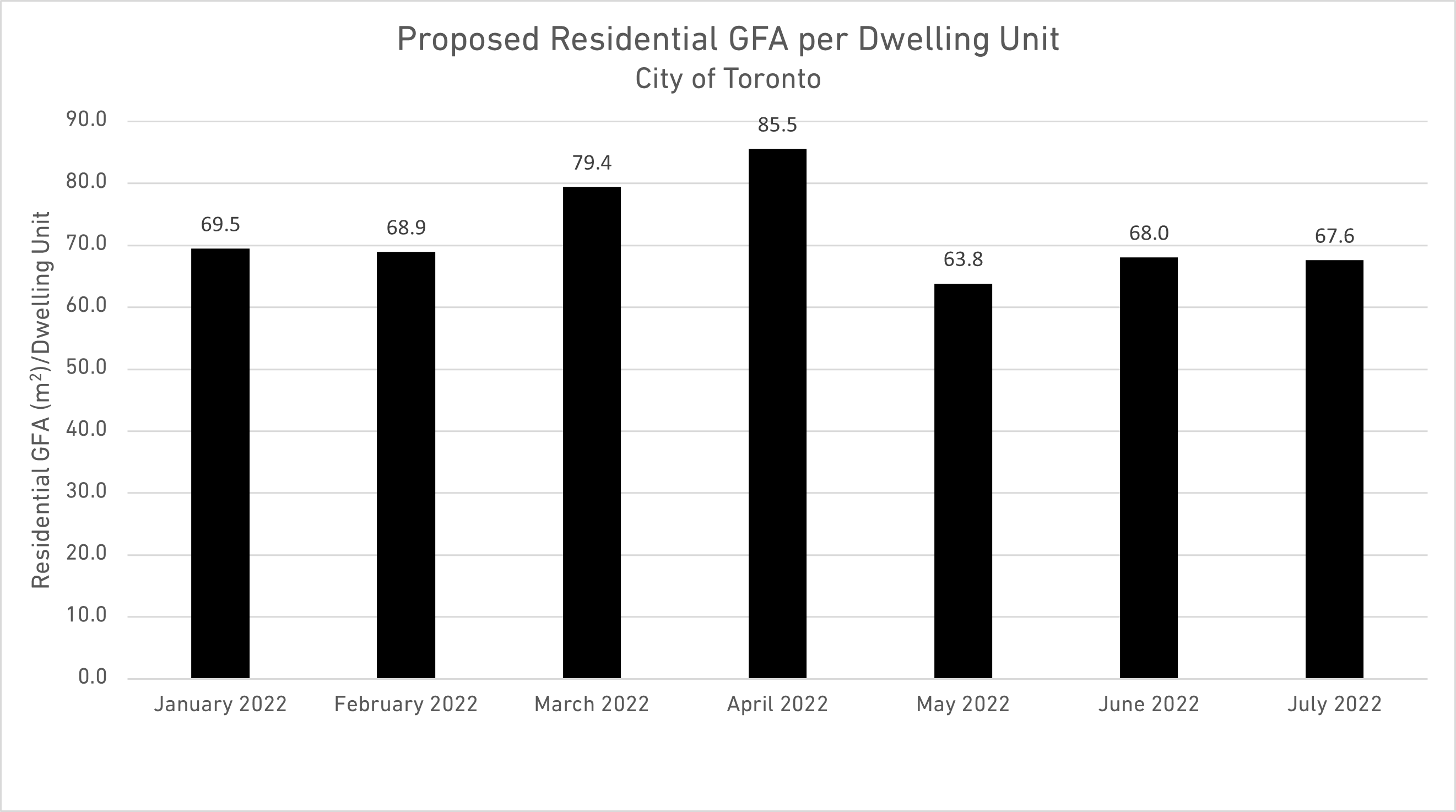

The average residential GFA proposed per dwelling unit was 67.6m² (727 ft²), which is in line with last month's 68.0m² (730 ft²). But this is a significant drop from the 71.4m² (780 ft²) proposed in July of 2021. The reduction in GFA per dwelling, coupled with less GFA proposed overall, is suggestive. Reducing the GFA per dwelling is analogous of trying to squeeze more units into the same area, which suggests that demand for units is high. But reducing the total GFA is having less space to build any units. This is suggestive of a supply-constraint. Could this be a calculated risk from developers? If future demand is low (or costs are high), they have hedged their bets by limiting how much they build. If future demand is high, they will have many units to sell.

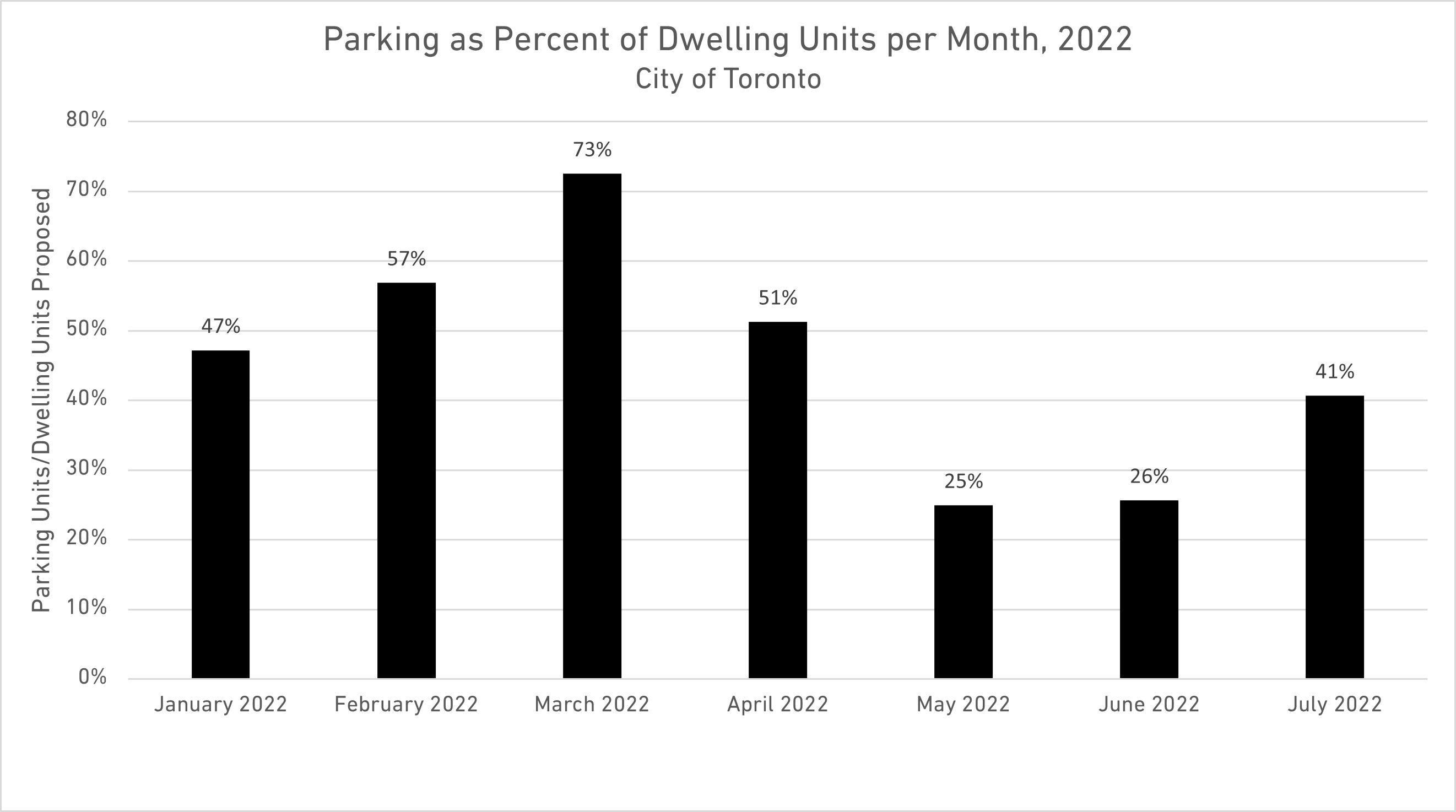

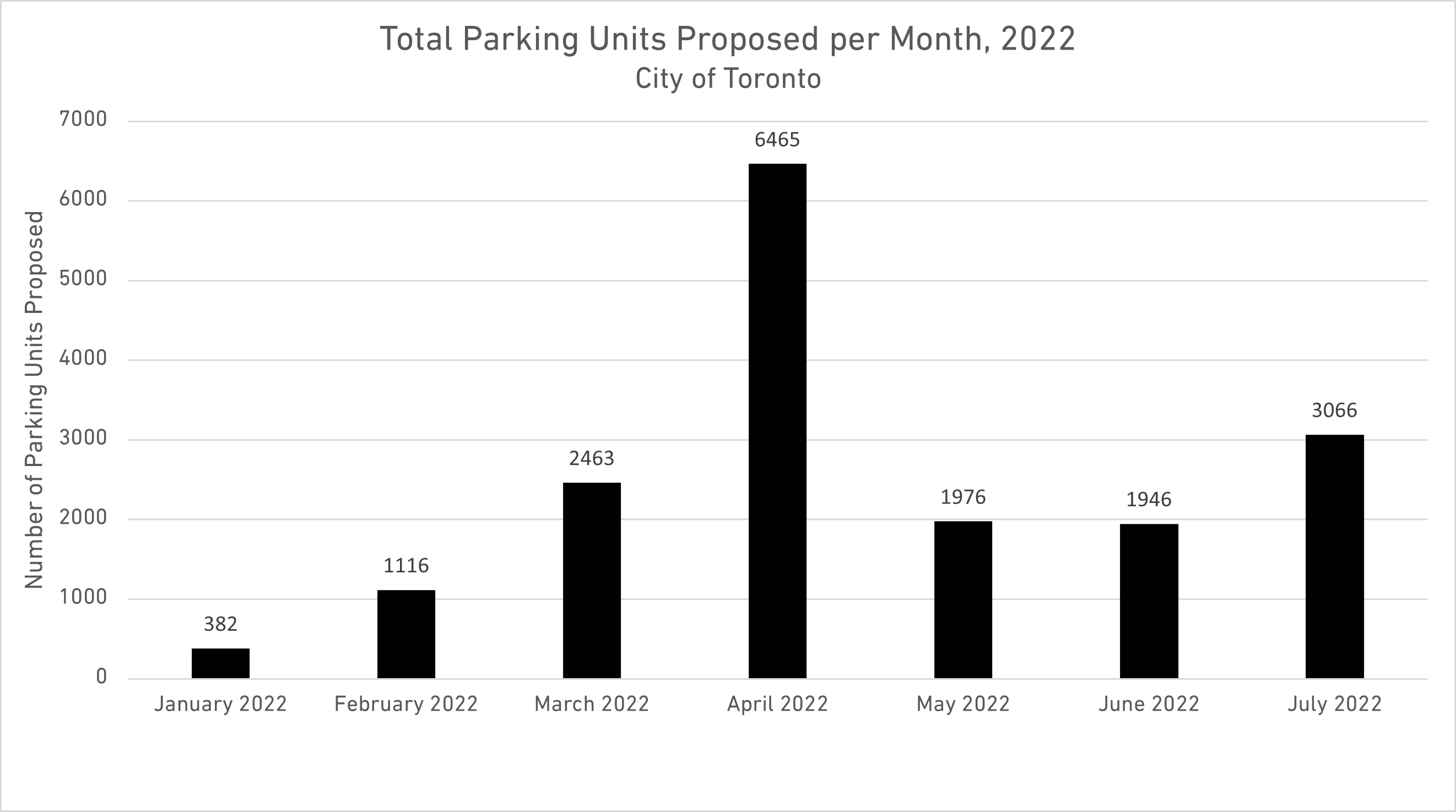

There was a bump in parking units proposed per dwelling units, from 25% last month to 41% this month. This is still below the year-long average of 47%, as well as July 2021’s 51%. This will be an interesting metric to watch as the city shifts from requiring parking minimums in the Zoning By-Law, to removing the minimums and (in some cases) requiring parking maximums.

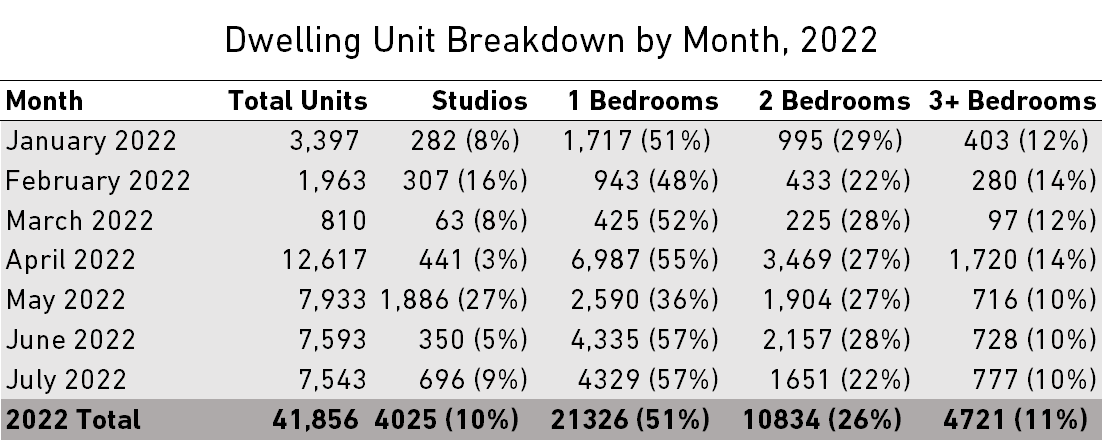

Of the 7,543 residential units proposed this month, 9% were studios, 58% were 1-bedroom units, 22% were 2-bedroom units, and 10% were 3+ bedroom units. As a reminder, the city's "Growing Up" guidelines require that at least 15% of units are 2-bedrooms, and 10% are 3+ bedrooms. While developers are proposing more than the minimum number of 2-bedroom units, they are once again proposing exactly the minimum number of 3+ bedroom units.

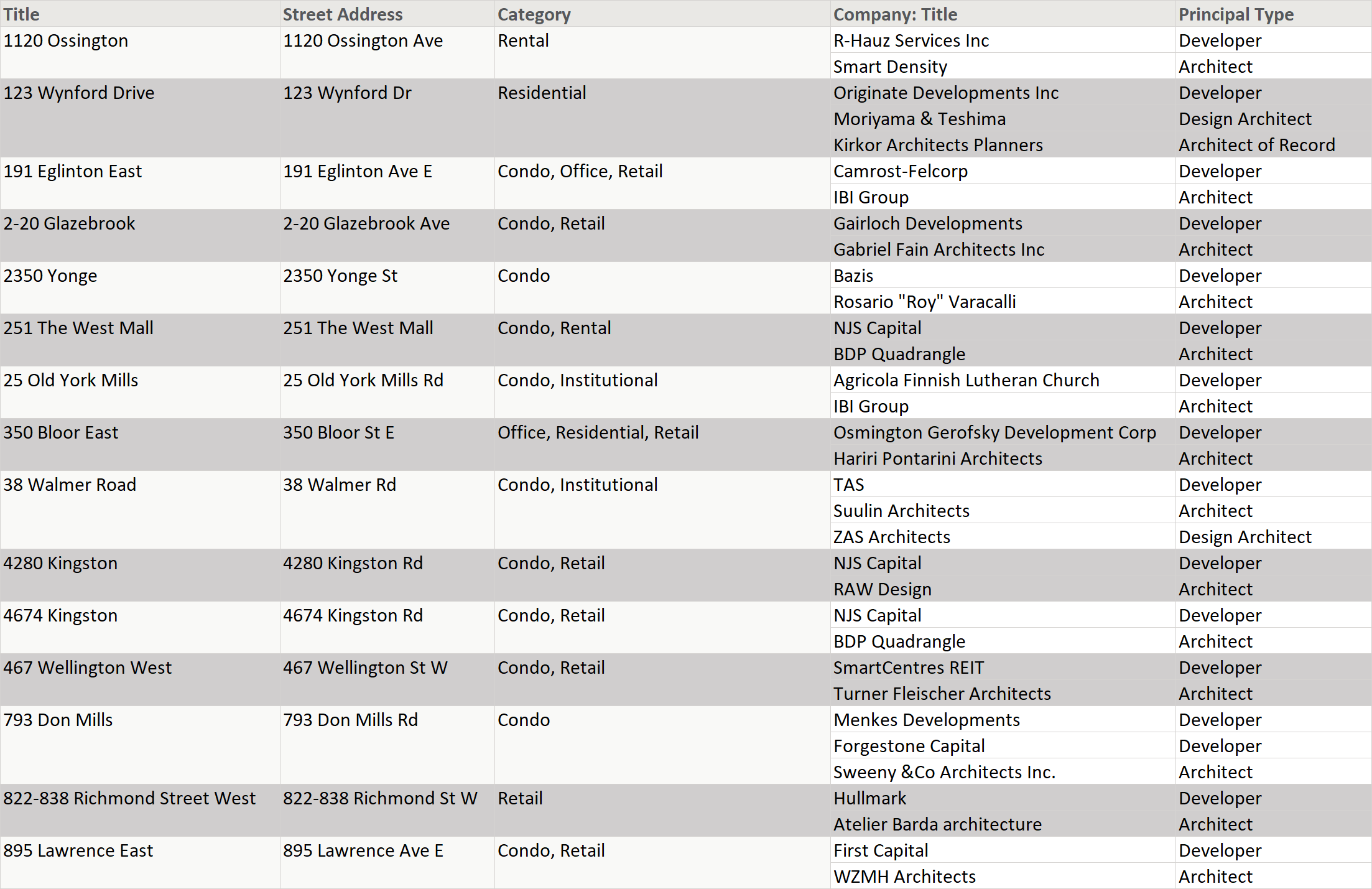

Finally, we have data on 189 companies working to bring these projects to life. Of these, below we list the 33 developers and architects.

Proposals are an indicator of developer confidence for future demand in the city. As the economic environment continues to cast uncertainty about the future of prices, costs, and policies, expect less ambitious developments going forward.

If you want to track all of this information live as it comes in, with your ability to customize reports and maps, set up a call about getting a tour of UTPro.

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UTPro.

Quantitative summary of new development proposals for Toronto, submitted in July 2022. Data from UTPro.

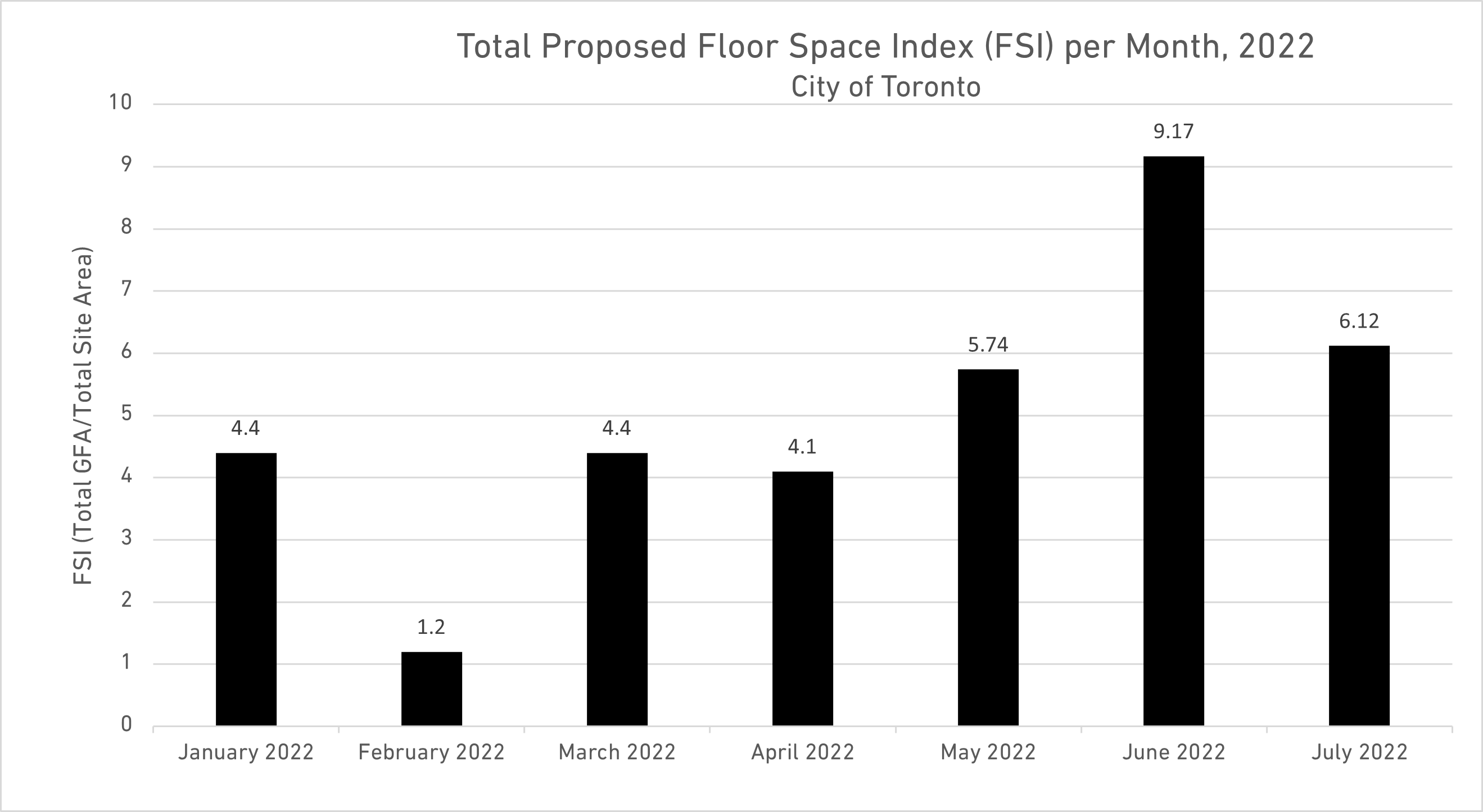

The total Floor Space Index (Total GFA divided Total Site Area) proposed in June, from 2017 to 2022. Data from UTPro.

The total Floor Space Index (Total GFA divided Total Site Area) proposed in June, from 2017 to 2022. Data from UTPro.

The Proposed GFA Mix in July, 2022 and 2021

The Proposed GFA Mix in July, 2022 and 2021

New proposals submitted in July, from 2017 to 2027. Data from UTPro.

New proposals submitted in July, from 2017 to 2027. Data from UTPro.

Proposed Office and Retail GFA per month in 2022. Data from UrbanToronto Pro.

Proposed Office and Retail GFA per month in 2022. Data from UrbanToronto Pro.

Ratio of Proposed Parking to Proposed Dwelling Units for the City of Toronto, 2022. Data from UrbanToronto Pro.

Ratio of Proposed Parking to Proposed Dwelling Units for the City of Toronto, 2022. Data from UrbanToronto Pro.

Proposed Residential GFA per Month for the City of Toronto, 2022. Data from UrbanToronto Pro.

Proposed Residential GFA per Month for the City of Toronto, 2022. Data from UrbanToronto Pro.

Residential GFA proposed per dwelling unit per month, January to July 2022. Data from UTPro.

Residential GFA proposed per dwelling unit per month, January to July 2022. Data from UTPro.

Total Parking Units proposed per month, January to July 2022. Data from UrbanToronto Pro.

Total Parking Units proposed per month, January to July 2022. Data from UrbanToronto Pro.

Dwelling unit mix proposed, January to June 2022. Data from UrbanToronto Pro.

Dwelling unit mix proposed, January to June 2022. Data from UrbanToronto Pro.

Architects and Developers for new July 2022 projects. Data from UrbanToronto Pro.

Architects and Developers for new July 2022 projects. Data from UrbanToronto Pro.

* * *

UT Pro is UT's premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a "large project" as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page. If you require an instant report on a specific area in the city, check out our Instant Reports.

For more information about UTPro, contact Edward Skira.

2.7K

2.7K