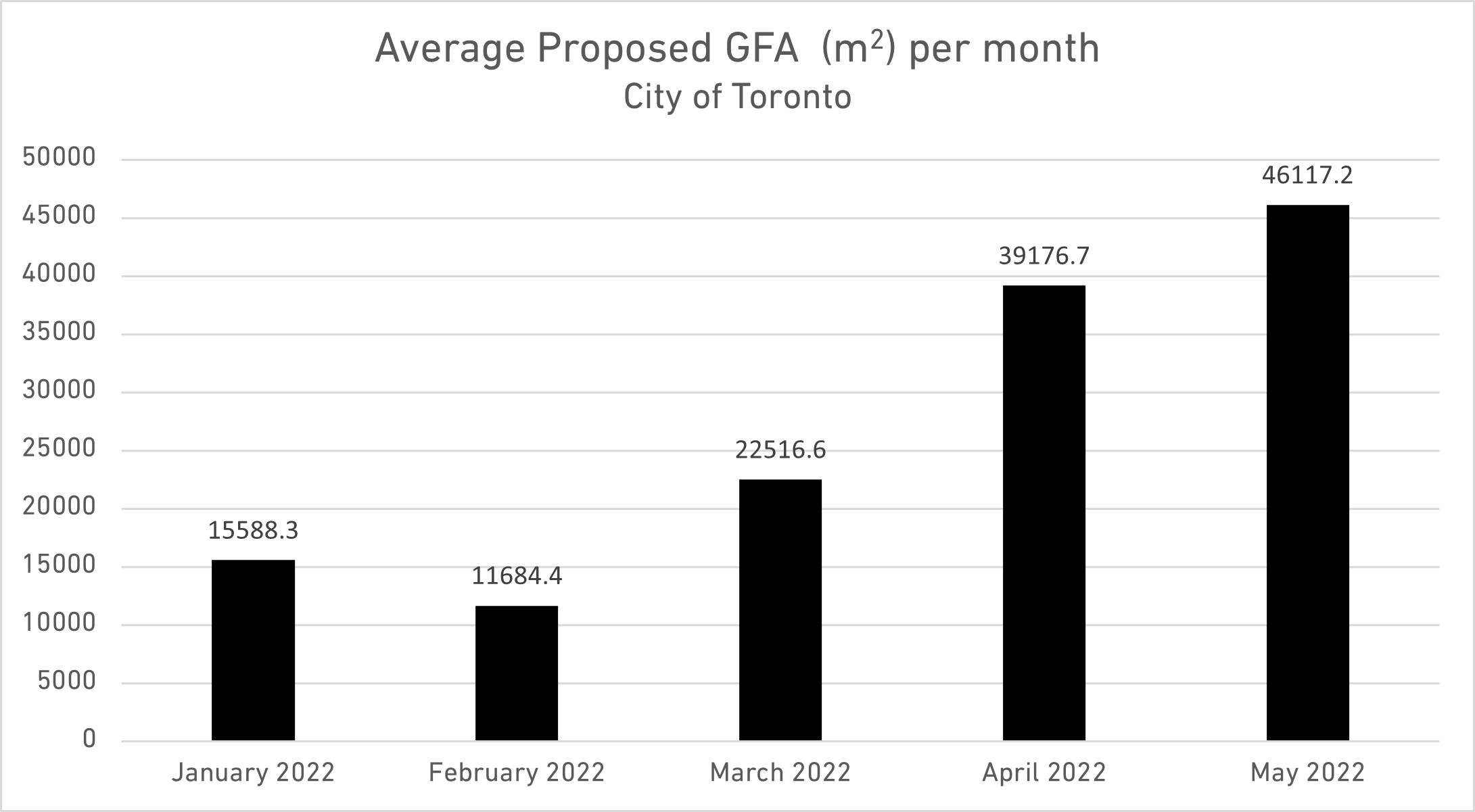

After the deluge of applications we saw in April, the number of new applications for real estate development in the City of Toronto returned to normal in May 2022. However, while the total GFA in April was almost twice as much as that of May, the proposed average GFA per project this month was higher.

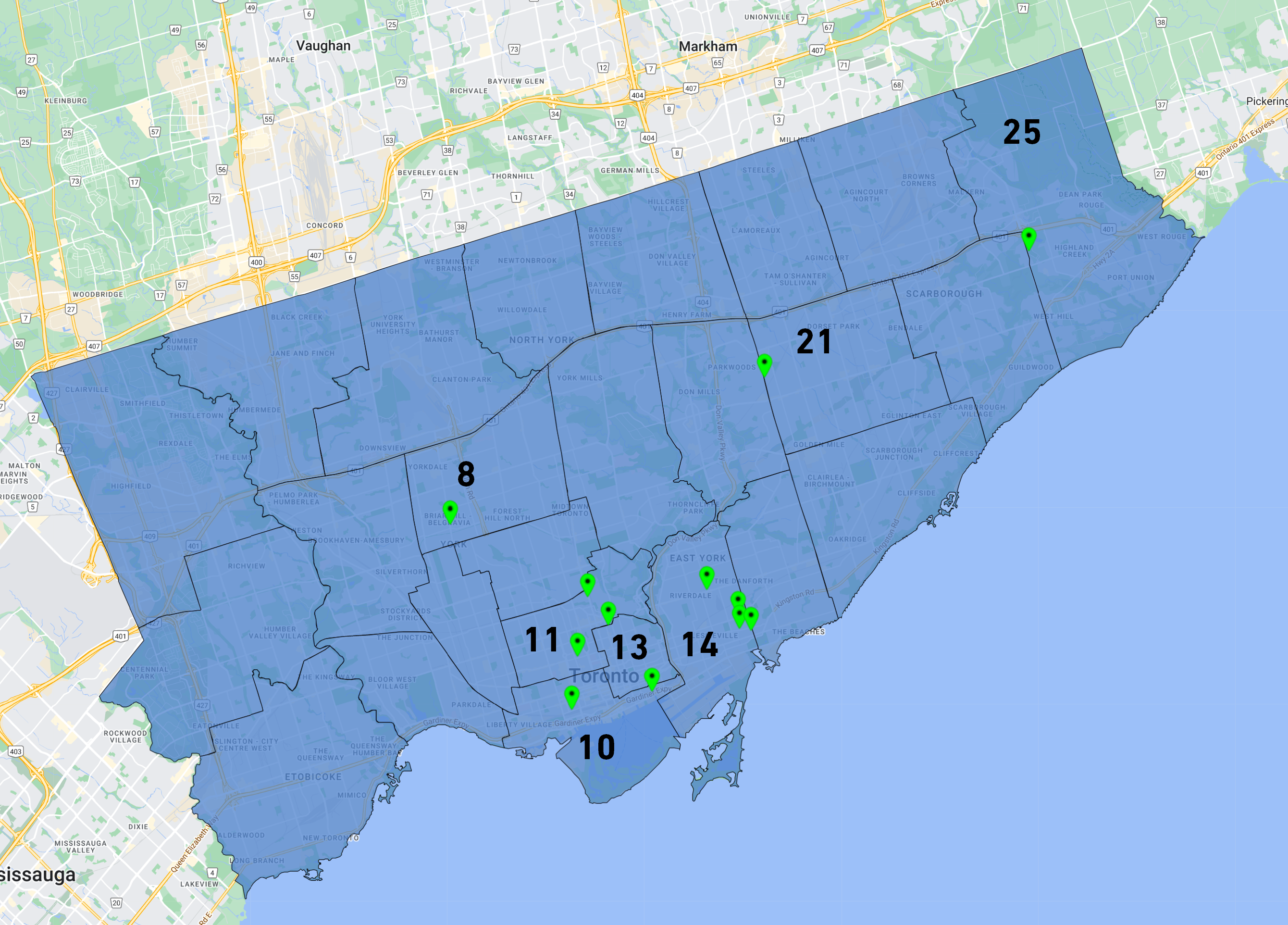

Map of May 2022 development by Toronto Wards, based on data by UTPro.

Map of May 2022 development by Toronto Wards, based on data by UTPro.

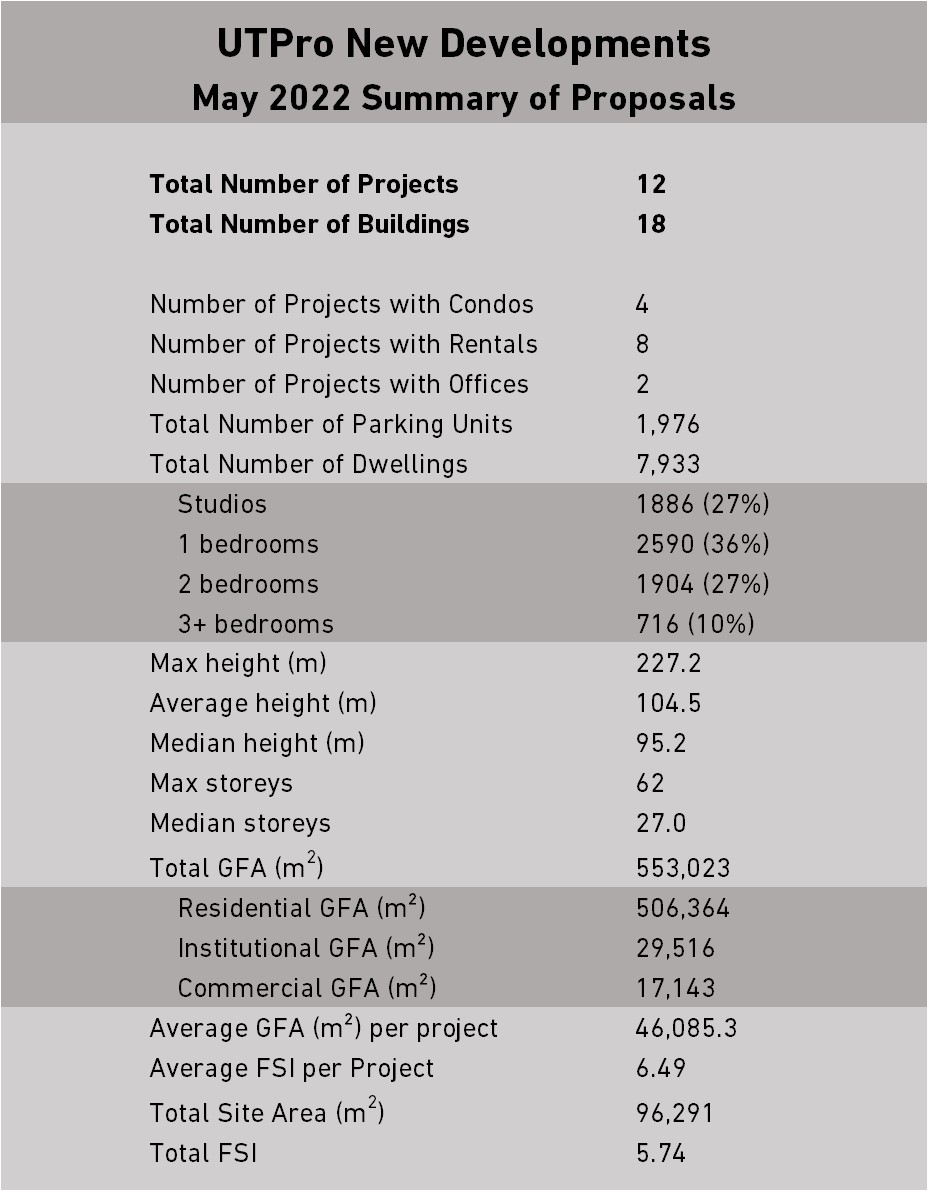

In May 2022, developers submitted applications for 12 projects across 7 wards, and proposed to build 553,023m² of Gross Floor Area over 96,291m² of land. While the tallest proposal is 62 storeys and the median proposal has 27 storeys, it would be possible to fit all of the GFA in 5- and 6-storey buildings on both sides of a 3-kilometre stretch of road.

May 2022 summary of development application proposals. Data from UTPro.

May 2022 summary of development application proposals. Data from UTPro.

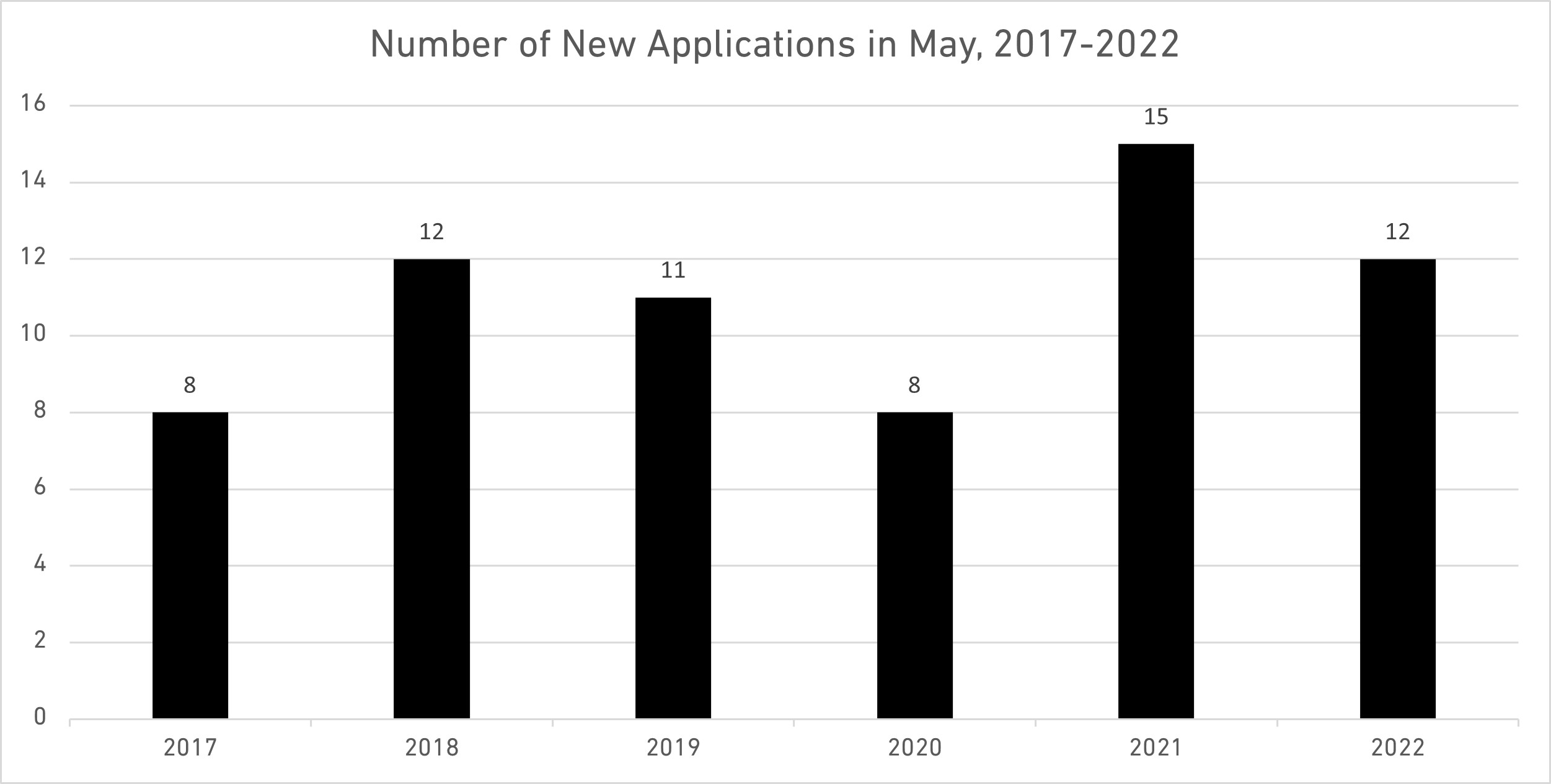

There was a 20% drop in applications compared to May of 2021, and a 76% drop from April, 2022. Since April saw many applications pushed through ahead of the updated Green Standards deadline, we would expect that May would produce fewer than normal applications.

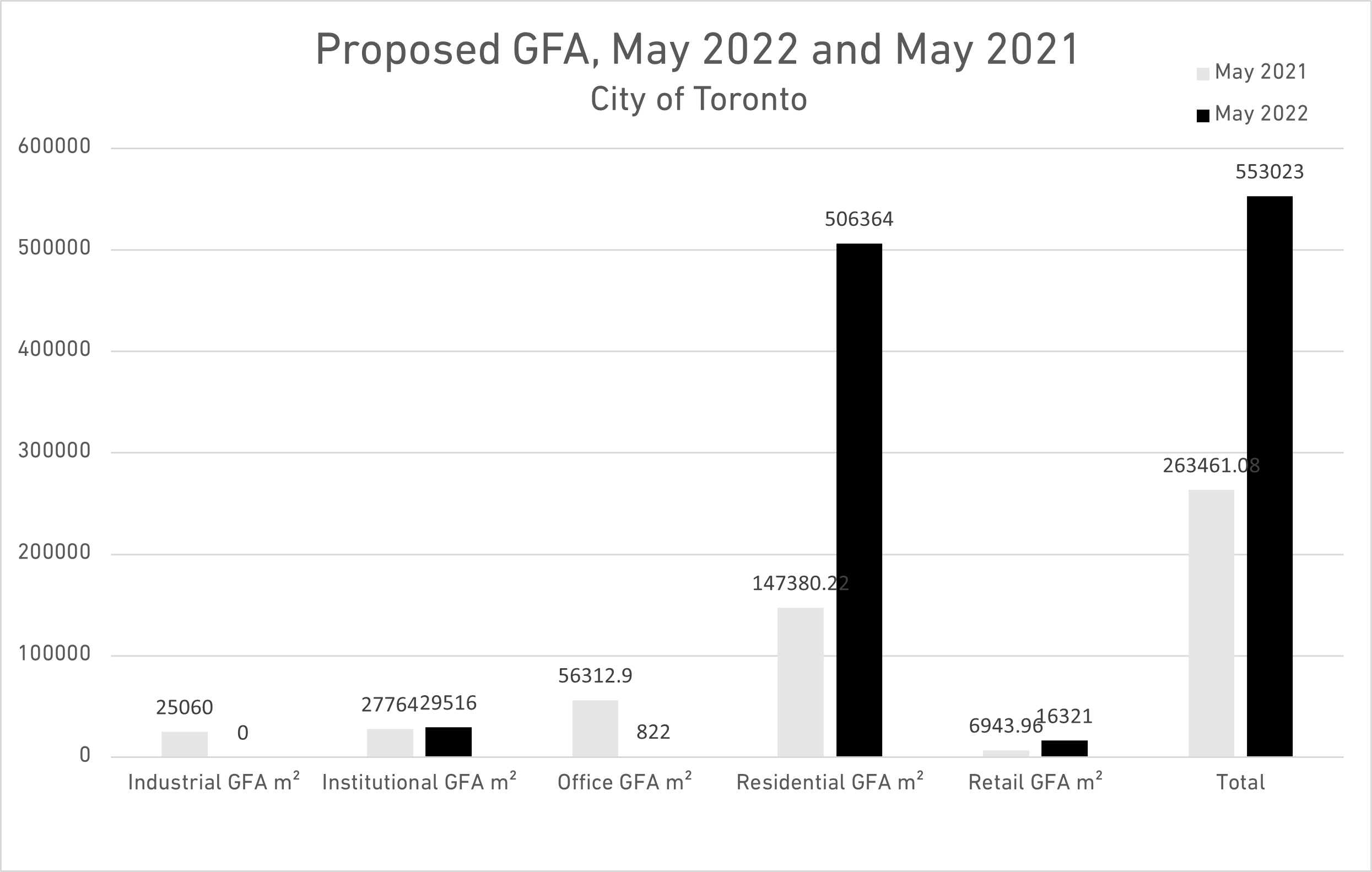

However, compared to the same month last year, this year developers are proposing more than twice as much GFA to build in the city. Despite this huge increase in floor area proposed, residential GFA per unit is only increasing by 13% over May of 2021.

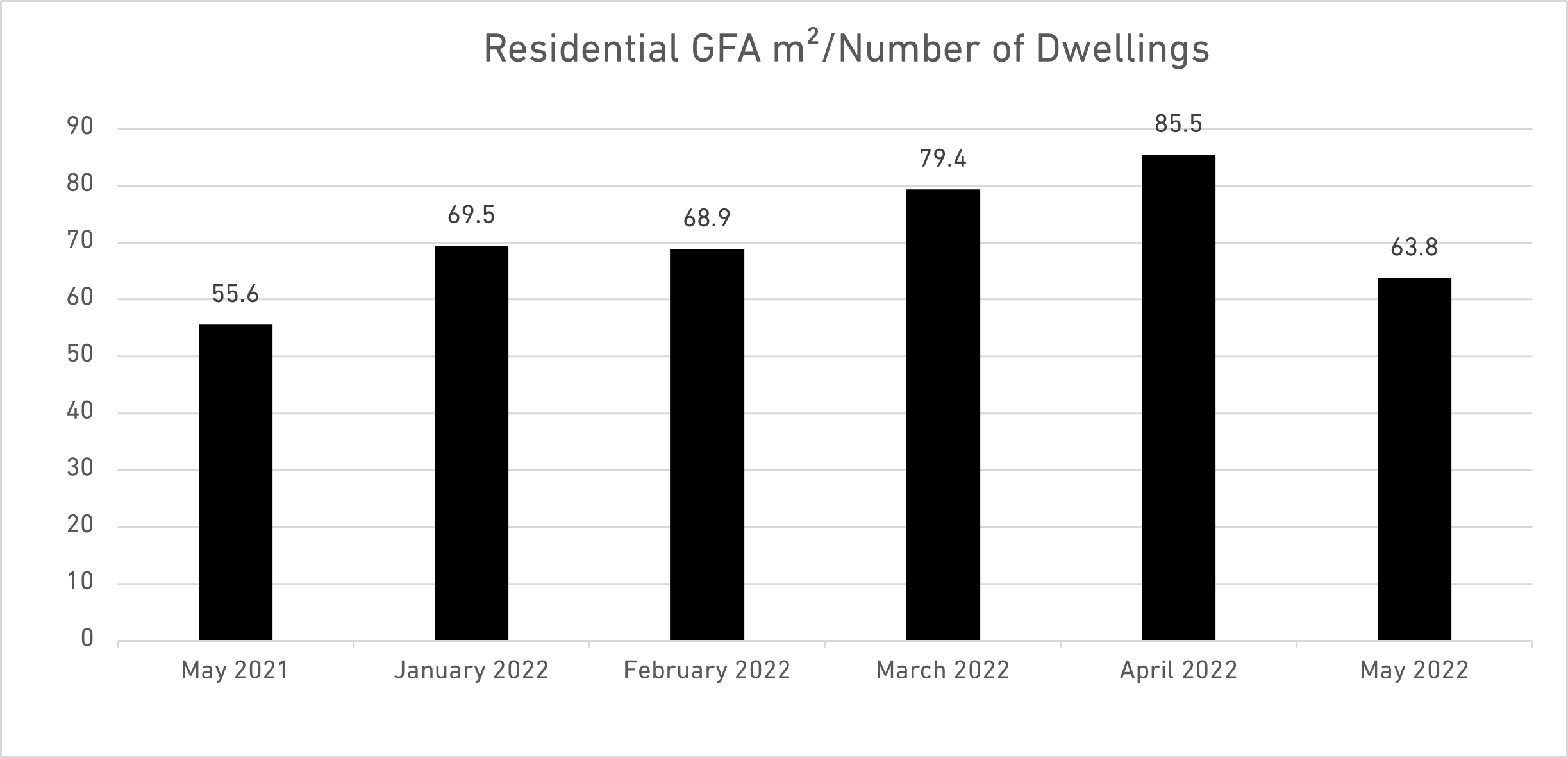

Curiously, the average residential GFA proposed in May 2022 was the lowest of the year. While higher than May 2021, at an average of 63.8m², this number is 19% lower than the average residential GFA proposed January through April of this year (75.8 m²). This means that the units proposed this month are, on average, 25% smaller than those proposed earlier in the year, even if larger than last May's units.

The biggest proposal in May was the Rail Deck District, a massive project proposing over 5,754 units across 388,000m² of GFA. Because it is a large outlier, we can exclude it from the analysis. Without the Rail Deck District, the average GFA per project drops to 15,001m² from 46,092m², but the residential GFA per unit increases to 64.4m² from 63.8m². This is a surprise, since approximately 25% of the units at the Rail Deck District are studios, so one would think removing these studios would drastically increase the average residential area.

The stability of the number, however, implies that developers are converging to uniform unit sizes, regardless of how many bedrooms they may have. This could have further implications about policy: simply mandating more (or fewer) bedrooms per unit may not do much about unit sizes.

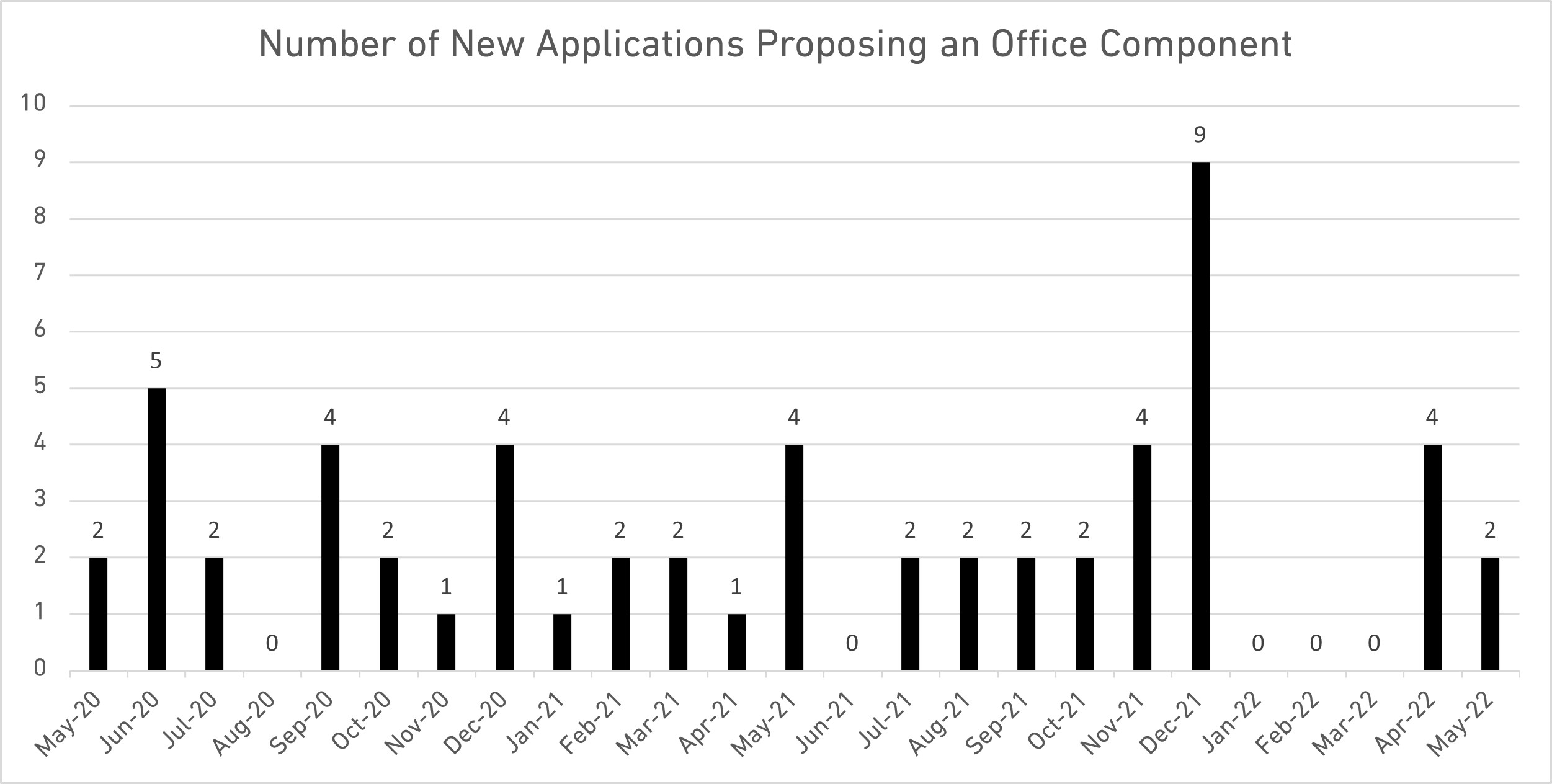

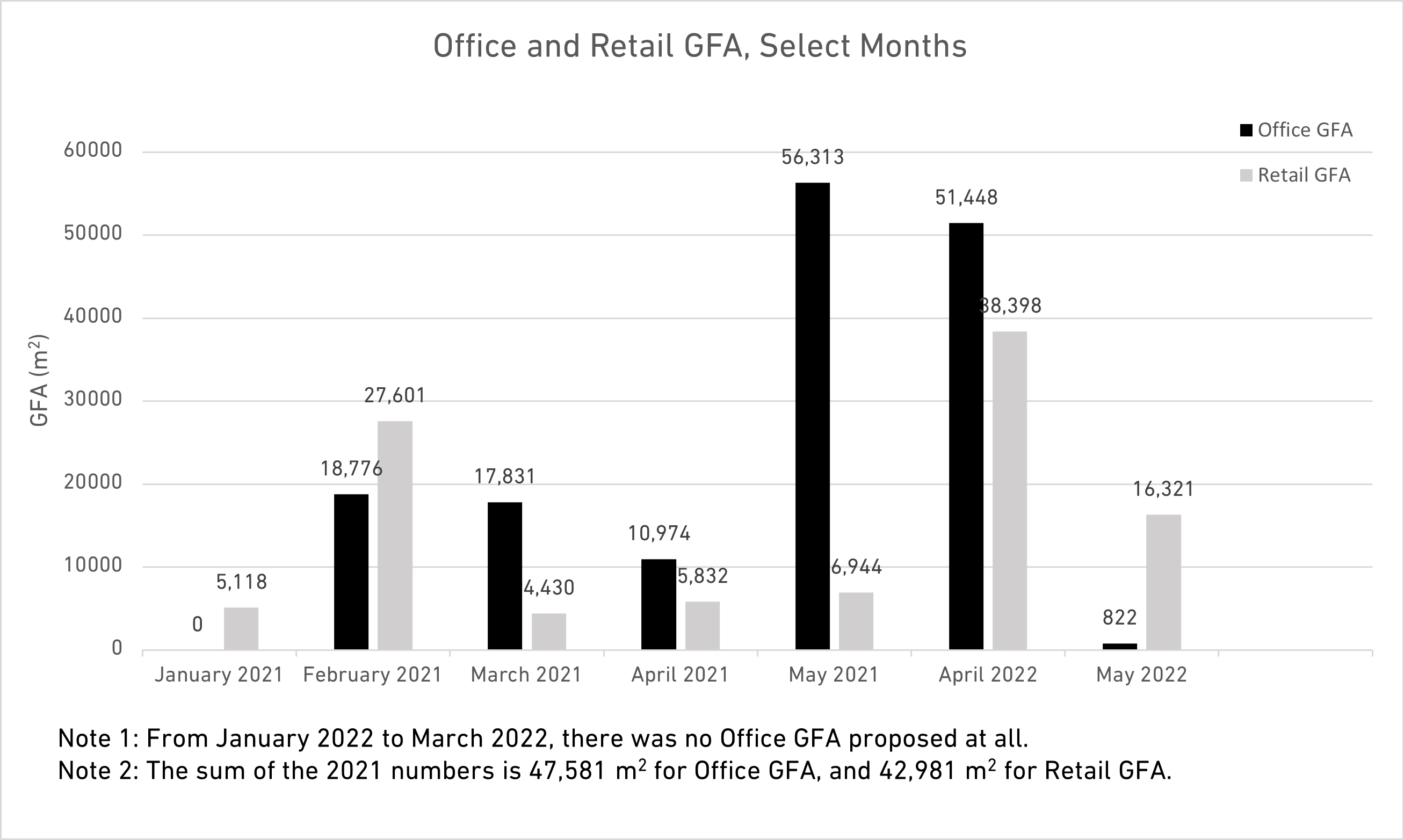

On a final note, proposals for office space continued to be weak, with only 822m² of GFA. Retail GFA proposals were also weaker than last year, perhaps reflecting general caution about the future of retail. There were more projects proposing to build rentals than condos, which may reflect the rising interest rate environment. As interest rates rise, securing a loan to purchase a home becomes more difficult. Population growth may also continue to outpace incomes and the development of new homes for sale. Both scenarios makes purchasing a home more difficult, pushing more people into renting.

This data is two months old. If you want to track this information live as it comes in, set up a call about getting a tour of UT Pro.

May 2022 and May 2021 GFA breakdown, based on data from UTPro.

May 2022 and May 2021 GFA breakdown, based on data from UTPro.

Residential GFA per dwelling, from select months. Data from UTPro.

Residential GFA per dwelling, from select months. Data from UTPro.

Number of new applications for May, 2018 to 2022.

Number of new applications for May, 2018 to 2022.

Number of new office proposals by month, select months. May 2022. Based on data from UTPro.

Number of new office proposals by month, select months. May 2022. Based on data from UTPro.

Office and Retail GFA proposals, select months. Data from UTPro.

Office and Retail GFA proposals, select months. Data from UTPro.

Average GFA per project. Data from UTPro.

Average GFA per project. Data from UTPro.

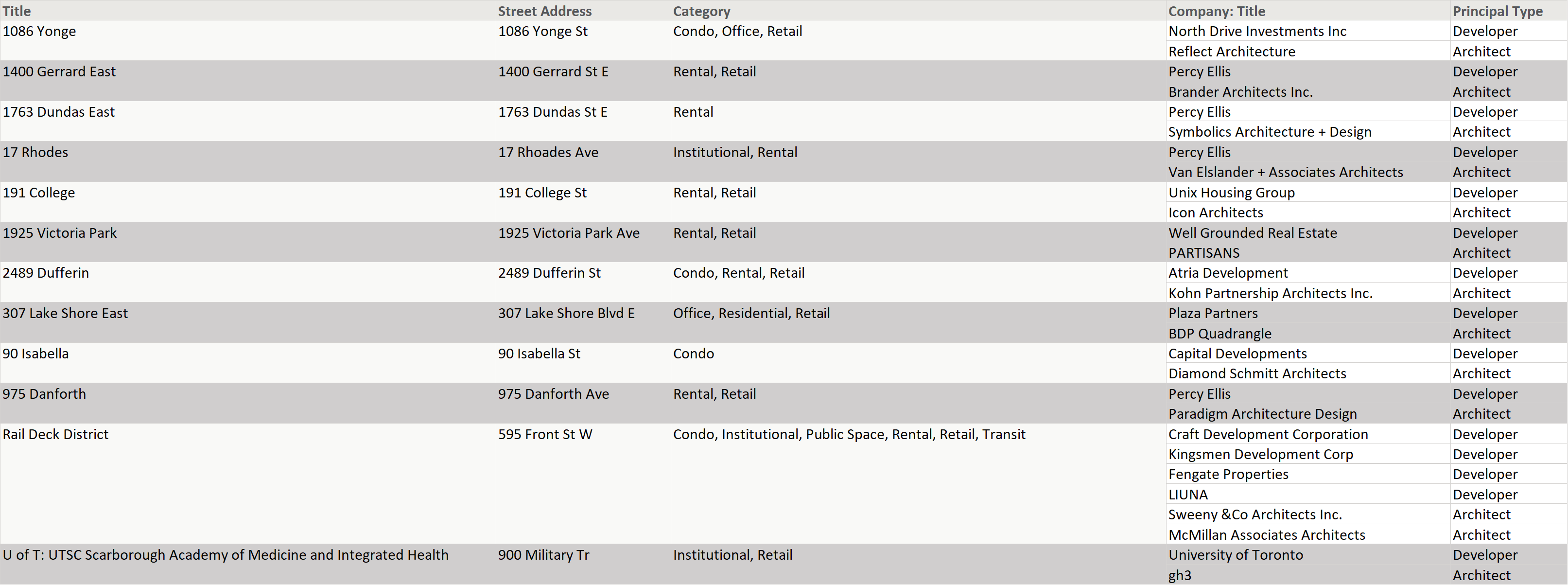

Information on developers and Architects of Record for each proposal in May 2022.

Information on developers and Architects of Record for each proposal in May 2022.

* * *

UT Pro is UT's premium database service that collects and reports information on development applications across the Greater Toronto Area.

This UTPro New Development Report analyzes new development proposals for large projects submitted to the City of Toronto. (UrbanToronto defines a "large project" as anything larger than a typical detached home.) These numbers are for proposals only, and are subject to change at any time up until (and sometimes even after) completion. Due to the early stage of the development process, some documentation may be missing; the numbers for some components of the data might not add up in some cases.

* * *

If you would like to stay updated on the latest development news, sign up for a free trial of the New Development Insider. And if you are interested in the data used to generate this report, you can get more details about the UTPro subscription database service here or on the official UTPro page.

For more information about UTPro, contact Edward Skira.

3.9K

3.9K