M II A II R II K

Senior Member

Karen Stintz and Rob Ford’s TTC problem: there are too many riders

December 6th, 2011

Read More: http://fordfortoronto.mattelliott.ca/2011/12/06/too-much-ridership/

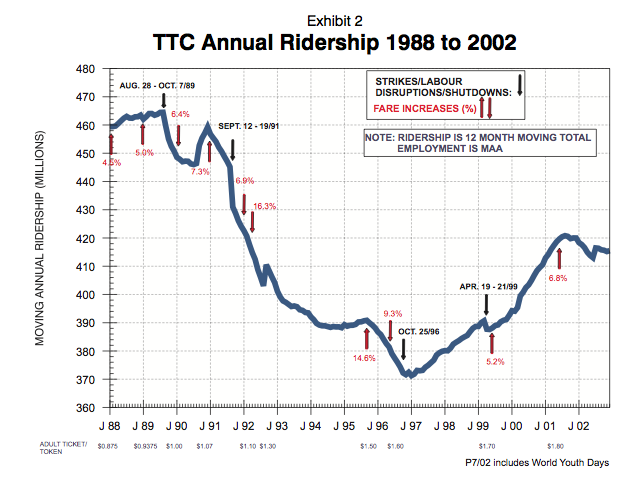

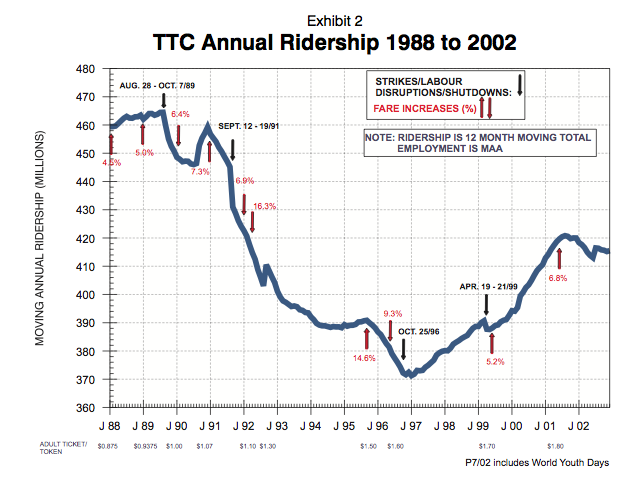

In 2002, the average Toronto resident paid $128.71 on their property tax bill to support TTC operations. In terms of net funding, transit came sixth, lagging behind Police, Housing, Fire, Debt Charges & Social Services. Per capita, transit’s level of financial support was barely above Transportation Services — the department responsible for building roads and maintaining highways. Annual ridership that year was 415 million, down four million from the year before. By 2011, that same average Toronto resident was now paying $337.95 to support transit. The TTC had transformed into a top priority, now following only the police as the largest recipient of net municipal spending. Ridership this year is estimated at 497 million. The TTC has added almost 100 million annual riders over the last decade.

This wasn’t accidental, nor is it an example of out-of-control spending. In 2003, the TTC launched a Ridership Growth Strategy, which was approved by council in 2004. (Voting against: Mike Del Grande, Doug Holyday, Norm Kelly, Giorgio Mammoliti & David Shiner. Rob Ford was absent for the vote.) Representing the first major public investment in transit since the 1980s, the strategy — even if never completely implemented — has seen ridership grow to levels never before seen in Toronto’s history. More notably, this ridership growth proved resilient even in the face of a weakening job market. What the RGS was successful in doing was creating a climate where more people relied on transit as a primary means of getting around the city. Last year’s TTC budget report described this phenomenon.

Over the long-term, changes in City of Toronto employment levels have tracked quite closely to to TTC ridership changes … However, starting in 2009, City of Toronto employment starting to drop but ridership continued to grow. Only in recent months (January 2011) have employment levels reflected growth over the same period in 2009. Favourable weather conditions last winter and economic uncertainty for riders have undoubtedly contributed to these strong ridership results. The large service improvements implemented in late 2008 have also prompted the growth as the service on the street more closely matches the service hours of the subway, giving riders far more choice in transit options.

.....

TTC Operating Budget vs. Ridership: http://fordfortoronto.mattelliott.ca/wp-content/uploads/2011/12/TTC-ridership-budget.jpg

December 6th, 2011

Read More: http://fordfortoronto.mattelliott.ca/2011/12/06/too-much-ridership/

In 2002, the average Toronto resident paid $128.71 on their property tax bill to support TTC operations. In terms of net funding, transit came sixth, lagging behind Police, Housing, Fire, Debt Charges & Social Services. Per capita, transit’s level of financial support was barely above Transportation Services — the department responsible for building roads and maintaining highways. Annual ridership that year was 415 million, down four million from the year before. By 2011, that same average Toronto resident was now paying $337.95 to support transit. The TTC had transformed into a top priority, now following only the police as the largest recipient of net municipal spending. Ridership this year is estimated at 497 million. The TTC has added almost 100 million annual riders over the last decade.

This wasn’t accidental, nor is it an example of out-of-control spending. In 2003, the TTC launched a Ridership Growth Strategy, which was approved by council in 2004. (Voting against: Mike Del Grande, Doug Holyday, Norm Kelly, Giorgio Mammoliti & David Shiner. Rob Ford was absent for the vote.) Representing the first major public investment in transit since the 1980s, the strategy — even if never completely implemented — has seen ridership grow to levels never before seen in Toronto’s history. More notably, this ridership growth proved resilient even in the face of a weakening job market. What the RGS was successful in doing was creating a climate where more people relied on transit as a primary means of getting around the city. Last year’s TTC budget report described this phenomenon.

Over the long-term, changes in City of Toronto employment levels have tracked quite closely to to TTC ridership changes … However, starting in 2009, City of Toronto employment starting to drop but ridership continued to grow. Only in recent months (January 2011) have employment levels reflected growth over the same period in 2009. Favourable weather conditions last winter and economic uncertainty for riders have undoubtedly contributed to these strong ridership results. The large service improvements implemented in late 2008 have also prompted the growth as the service on the street more closely matches the service hours of the subway, giving riders far more choice in transit options.

.....

TTC Operating Budget vs. Ridership: http://fordfortoronto.mattelliott.ca/wp-content/uploads/2011/12/TTC-ridership-budget.jpg